LEO 🦁 Chart Looking Solid (Bought More Crypto And Still On BlackHole DEX)

A little bit of a survey the land and update on a few of the things I have been doing at this point in the cycle. I have a small LEO bag. I mainly took some HIVE and bought more LEO and it's doubled up. I thought the premise was interesting that they were mainly going to have no further inflation and that it was going to be harvesting revenue from the LeoDex to buy back LEO so I put some in over there. This is a good example of ecosystem plays and noticing the flow of what is going on currently. As long as it is outpacing BTC, HIVE, and the US Dollar and DOGE I consider it a win. I don't have a ton of projections for it but as alt season cranks up I could see more and more people doing various swaps to get to other opportunities on various chains and the LeoDex could be a place they want to do their swaps at.

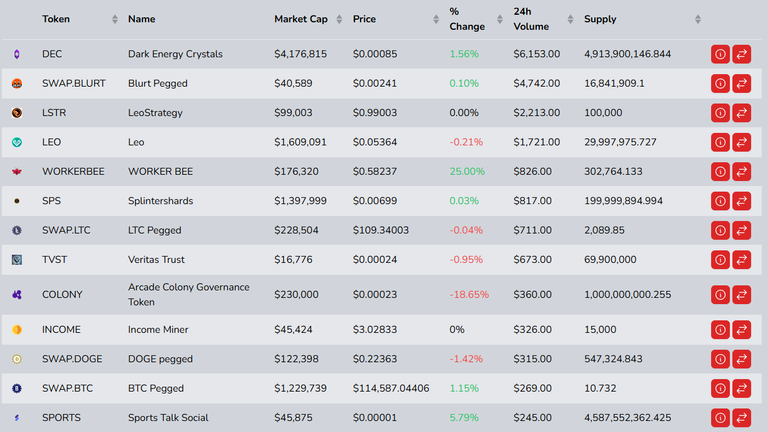

Something is also going on with Blurt as well. We are just seeing a lot of volume on Hive-Engine for it. That tells me that investors are taking a bigger and bigger position because they know something big is coming or they are getting in position for a large pump. That is what I did with DOGE in 2019. The project had largely been abandoned but I knew that all roads lead to the DOGE. 🐕

You aren't going to catch absolute bottoms or absolute tops typically but when you are in the game long enough and see various trends and understand and observe people's actions you can somewhat predict the future. You just have to be right more than you are wrong. My guys are still ball'n over 5 years later with big things on the horizon.

The fact that the LEO assets and Blurt are doing more than LTC, BTC, and DOGE on the Hive Engine tells you something. People are moving deeper into these various other plays vs exiting via those other assets. (LTC, BTC, DOGE)

Days like the last couple of days where some of the upward momentum retraced will shake a lot of people and they will deviate from their plans. I still pumped a little bit more in today and bought $SUI , $ICP, and $AVAX

Various bags working and building at this point even if some plays seems small as long as you have decent energy and capture some 5X and 10X plays you can then snag some 20X and 100X type stuff and as long as you don't try to ride it into unnecessary overtime you can set yourself up with a goose that lays a golden egg. On a base level that will be the HIVE Backed Dollar Interest. Right now there are better plays out there.

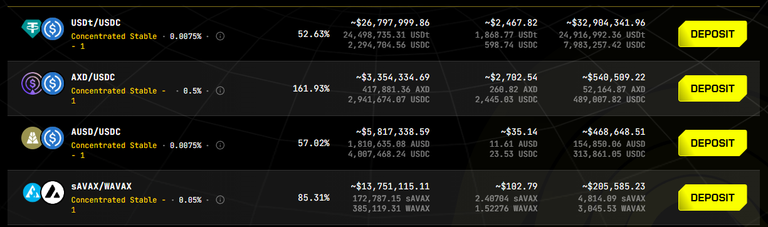

Even though 52% is good for USDT / USDC parings it isn't something I would necessarily be in at this point in the cycle. The sAVAX/WAVAX pool is paying 85% currently and if someone is already going to be holding and AVAX position it could be worth the contract risk. AI said "SAVAX stands for BENQI Liquid Staked AVAX"

I will likely put in a small position over there and monitor it. Seems like it has been holding the AVAX peg pretty close and that can print some rewards which I can roll into other pools. Typically when I'm on a DeFi play like this I try to keep getting the gains and moving to pools that make sense until the returns start to dry up. They are always going to somewhat want to drive demand to the farming token and you want to be careful about going to deep into buying that and if you do it needs to be right at the beginning to prime the pump if the APRs are really high on pools that have it in there. You can check out the various pools on that DEX.

https://blackhole.xyz/liquidity

Conclusion

It's easy to lose sight of various things or thing that you don't have that big of a position in something but the more important thing is to have various things working and understand the flow and not get too tribal. There are projects I don't like that I hedge my bets with. I really don't like XRP but I keep a position in it.

Also when the HIVE fork happened I continued to post everywhere and have tested OpenChat and I'm on the Arena as well. The future is Multichain!

Posted Using INLEO

I removed most of my stake in LEO a while ago after the whole CUB thing, but I hope this turns out well for them. Anything that brings more positive attention to HIVE isn't a bad thing.

CUB Finance was a banger for me partially because my timing and rotation was good on it. Partially because I had already been on Pancake Finance and had caught big wins with both BNB and with CAKE so I rotated a good chunk of CAKE into CUB in that first week and then rotated to other pools after that. When we had that huge pullback in mid 2021 I had rotated into the stablecoin pools on Cub Finance and those were bangers for me printing at about 40% APR then I was able to redeploy that when we came back up in Q3 and Q4. Polycub would have been a banger for me but I didn't rotate at the right time and I was fairly heavy in it. I also got burned when they had bridging issues with bHBD.

So with this LEO play I just have a small amount in and seeing if it can produce 10X on a small bag. I like a lot of the concepts they are testing. I like the fact that they are multichain but I don't like the fact that they launched the two farms and then partially abandoned the participation on those chains. We could certainly say those types of farms somewhat had their run but that is another reason I'm engaged in that BlackHole DEX. They are trying to create more value for the farming token.

All these concepts together make a fuller formed ecosystem. The L1 chains need Money Markets and DeFi and that is one area HIVE and ICP lack in.

I liked that Cub Finance was an extension of the HIVE assets over to the BSC to provide more of those capabilities but unfortunately it couldn't continue.

I was in CUB and PolyCUB as well. Though I didn't play it as smart as some people did. I had too much faith in the system and too little knowledge of DeFi. A lot of my gains last cycle went into CUB and PolyCUB and I ended up riding it all the way down to pretty much nothing. Totally my fault, but it still left a bad taste in my mouth. CUBLife that SSUK ran did much better for me as he was managing it and I was able to bank a lot of LEO back then. I still hold about 1/4 of it.

It was certainly tough with PolyCub because the overall market was falling apart when that one was running. When the tide is going out it will take the wind out of the sails.