Bitcoin price 070925

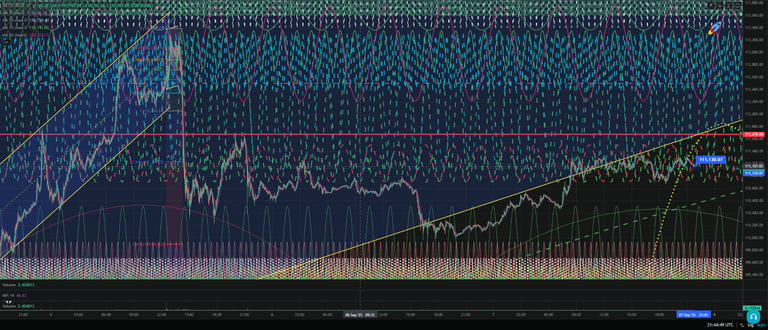

BTC has fallen from $113,402 USD to a 3-day low of $110,021 USD.

https://bitcointicker.co/stamp/btc/usd/3days/

This morning BTC has mostly traded sideways, up to a high of $111,412 USD and down again.

https://bitcointicker.co/stamp/btc/usd/3hr/

I keep an eye on the price of Bitcoin.

Latest Block: 913,638

"A total of 1,119.80 BTC ($124,574,249) were sent in the block with the average transaction being 0.2232 BTC ($24,830.29). AntPool earned a total reward of 3.13 BTC $348,202. The reward consisted of a base reward of 3.13 BTC $348,202 with an additional 0.0151 BTC ($1,679.83) reward paid as fees of the 5,016 transactions which were included in the block."

https://www.blockchain.com/explorer/blocks/btc/913638

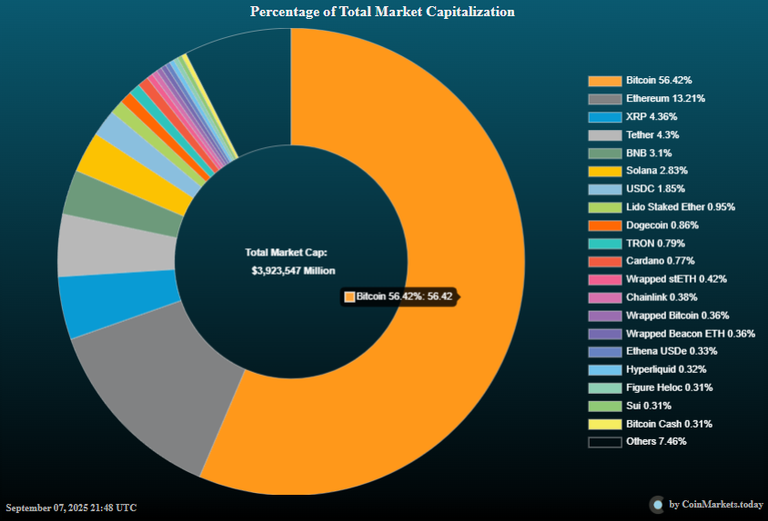

USDT continues to dominate the crypto market,

followed by BTC, ETH, USDC, SOL, XRP and others.

24 hour volume shows $46.5 billion dollars of USDT traded, vs $21.2 billion of BTC.

₿418,547 of USDT > ₿191,378 of BTC

Total Bitcoins left to mine: 1,082,369

Next halving: 946 days until April 11 2028

Mayer Multiple: 1.09 (-)

https://charts.bitbo.io/mayermultiple/

Bitcoin is under the low-bearish line again, how low will it go in September 2025?

https://www.bitget.com/trading-bot/spot/BTCUSDT

If this is it, how low will it go by the end of 2025?

https://www.tradingview.com/symbols/BTCUSDT/?timeframe=ALL

Will we ever see 30k BTC again, or can it go lower?

CoinMarkets.Today

BTC market cap dominance is down to 56.42%, from 56.61% 2 days ago.

Will we see another ATH this year?

How much BTC will you buy in September 2025?

https://bitcointicker.co/stamp/btc/usd/1hr/

Down to $111,143 USD

at 3:50pm MST on September 7th 2025

Up and down, up and down again.

Do you think that BTC already peaked for this cycle?

!PIZZA

Well here is where we have to use some discernment. I will refer first to the stock to flow, then to the power law.

On the halving cycle, we are 946 days away from the next halving, when the miner rewards will be cut in half.

In late 2013, early 2014, this puts us after the ATH.

In late 2017, there was still an ATH ahead.

As well, at the end of September there was another ATH ahead shortly afterwards.

Stock to flow seems to be undervalued, due to increased uncertainty. ['Bitcoin’s price lagging well below S2F expectations reflects the maturing market’s complexity, broader economic factors, and limitations of supply-only models. While the potential for higher prices exists, there is more uncertainty than in previous cycles, and it is important to consider S2F as just one part of a much bigger analytical toolkit'*]

Long term power law puts the lower bound at $50k, upper at $510,000. I always try to keep a long term view of BTC because it continues to surprise me, and betting against it is rarely a good idea.

In 2030, that lower bound is $174k, so we should simply take a longer view and adjust our expectations accordingly. BTC will probably still be ticking along, one block at a time, so the next 5 years we should acquire as much as we can with that $491k median in mind. I think we are close to this cycles top, if we haven't seen it already, September is usually a good time to buy in anticipation of one more top this Oct/Nov/Dec. My humble observations suggest that opportunity has already begun.

However I see Silver as a great opportunity right now that no one should be ignoring.

Silver in the hand is worth a barrel of cash! !ALIVE !PIZZA

!LOL

lolztoken.com

They enjoy the boos.

Credit: reddit

@darkflame, I sent you an $LOLZ on behalf of kerrislravenhill

(1/6)

$PIZZA slices delivered:

kerrislravenhill tipped darkflame

@darkflame(2/15) tipped @kerrislravenhill

Come get MOONed!