Dalio’s Long-Term Debt Cycle – The Rise and Reset of Economies (Part 5 in Series)

Welcome back to my deep dive into the world of market cycles. In Part 1, I laid out seven powerful cycles every investor should keep an eye on.

We’ve talked about long waves, innovation cycles, and even mathematical models tied to Pi. Now, it’s time to tackle something every economy dances with but few truly understand: debt.

🏦 Ray Dalio’s Big Idea

Ray Dalio, founder of Bridgewater Associates, has spent decades studying how economies work. He boiled a lot of it down to this: debt is both the fuel and the fire. Too little credit, and growth stalls. Too much, and you’re begging for a blow-up.

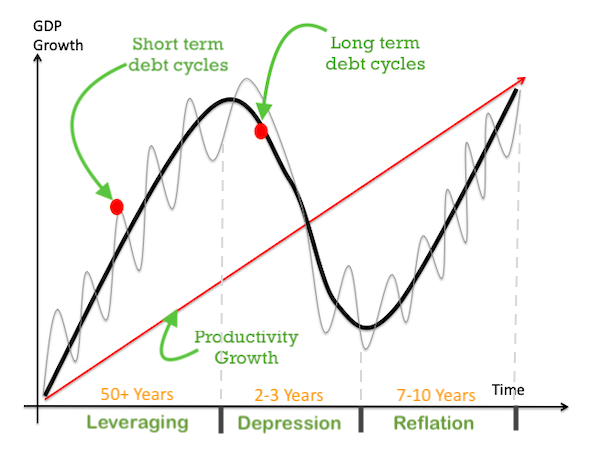

Dalio calls this pattern the long-term debt cycle, which usually lasts 50–75 years. During this time, countries (and individuals) borrow, spend, grow, and then—eventually—hit a wall when the debt can’t be paid back. That’s when the painful part, deleveraging, begins.

📉 How It Unfolds

Dalio breaks it down into stages:

- Early Growth: Borrowing helps create new businesses, jobs, and expansion. Everyone feels rich.

- Bubble Formation: Easy credit and optimism lead to asset bubbles—stocks, housing, crypto, you name it.

- Top of the Cycle: Debt levels hit unsustainable highs. Central banks start hiking interest rates to cool things off.

- Deleveraging (Crash): Asset values drop, defaults spike, and debt has to be written down or inflated away.

- Reset: After the storm, debt levels are low again, and the next growth cycle can begin.

Sound familiar? It should—think 1929, 2008, and (arguably) what’s brewing right now with global debt loads.

⚠️ Why It Matters for Investors

Dalio’s cycle teaches one big lesson: watch the debt levels like a hawk. When borrowing fuels everything—from stock buybacks to home prices—you’re not in a “normal” market anymore. You’re in the late stages of the cycle, where risk is highest.

He also emphasizes diversification and holding assets that can survive inflationary or deflationary periods—things like gold, commodities, and global equities.

📊 Chart for Reference

Dalio’s own visual of the debt cycle is worth seeing:

Source: Bridgewater Associates

💬 Final Thoughts

Dalio’s debt cycle is like the heartbeat of capitalism—it pumps life into the economy, but if it beats too fast, the system collapses under its own weight. For investors, knowing where we are in this cycle can mean the difference between catching the next big wave or getting wiped out by the undertow.

📚 Next Up: Part 6 will break down the 18-Year Real Estate Cycle, which is all about property booms, busts, and the predictable nature of housing markets.

✍️ Stay Connected with Grandpa Pulse

![]()

Crypto hustler • Market cycles explorer • Faith & finance from a front-porch philosopher

📲 Follow me on social:

🐦 X (Twitter)

💬 Blurt.blog

📺 YouTube

Posted Using INLEO