Part 2: Kondratiev Wave – The 50-Year Tech and Innovation Cycle

If you missed Introduction to this series, I broke down seven major economic cycles that investors have used for over a century to make sense of market booms and busts. One of the longest and most fascinating of those is the Kondratiev Wave—and that’s exactly what we’re diving into here in Part 2.

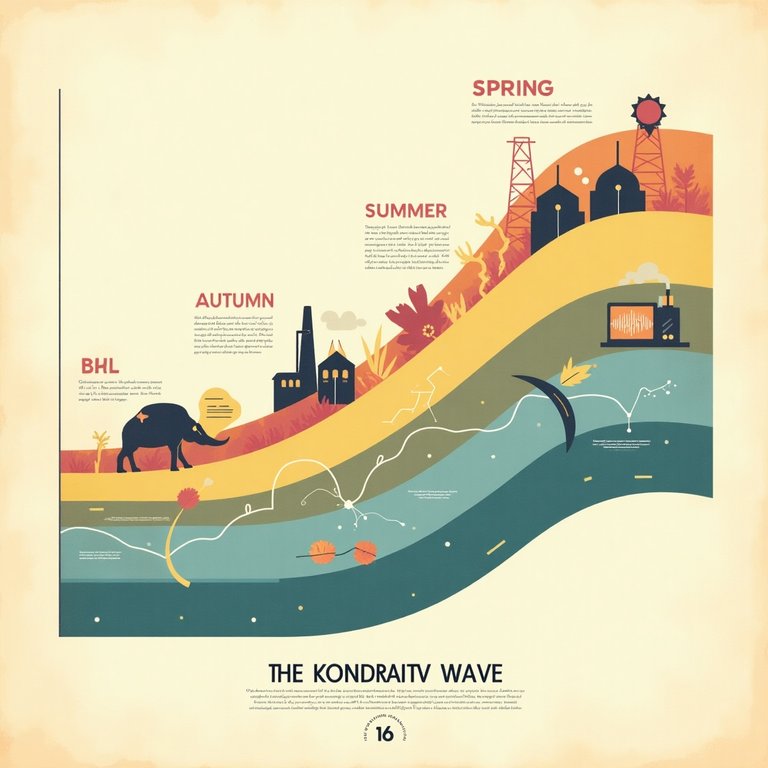

The four seasons of the Kondratiev Wave illustrated visually: Spring (growth), Summer (inflation), Autumn (speculation), Winter (recession).

Let’s go back about 100 years. A Russian economist named Nikolai Kondratiev (don’t ask me to pronounce it) noticed something strange: when he looked at long-term economic data, he saw a pattern that kept coming back. About every 45 to 60 years, the economy seemed to go through a massive wave—starting with innovation and growth, building up to crazy speculation, and then crashing back down to reality.

He called these patterns “long waves,” and he believed they were driven by technological revolutions. Steam engines, electricity, the automobile, computers, the internet—every time we get a world-changing invention, it sets off a new wave of economic energy. But like all things, the hype eventually burns out, and the cycle resets.

The Four Seasons of the Kondratiev Cycle

To make it easier to understand, people often break the wave into four “seasons”:

- Spring (Recovery) – A new technology enters the scene. People start building again, jobs open up, optimism rises.

- Summer (Boom) – The economy overheats. Prices rise, inflation kicks in, and speculative bubbles start to form.

- Autumn (Speculation) – Everyone thinks they’re a genius investor. Stocks soar. But cracks start showing.

- Winter (Crash/Deflation) – Debt collapses, unemployment rises, and the system has to reset. Then comes a new Spring.

So What’s the Point?

Look, nobody’s saying the Kondratiev Wave is a precise trading tool. It’s not going to tell you what Tesla will do tomorrow. But what it does give you is a zoomed-out view of where we might be in the bigger economic picture.

If we’re early in Spring, maybe it’s time to lean into innovation. If we’re in late Autumn, it might be wise to pull back from frothy markets. And if it feels like Winter—like things are breaking down and everyone’s panicking—maybe that’s exactly when the next great opportunity is brewing.

Final Thought

Kondratiev paid a heavy price for his ideas—the Soviets didn’t like that he suggested capitalism could survive on its own, so they silenced him. But the idea he planted—that economies move in waves of innovation, growth, and renewal—still echoes a century later.

If anything, the Kondratiev Cycle reminds us that what feels new is often part of a much older rhythm. And for long-term investors? That’s worth listening to.

✍️ Stay Connected with Grandpa Pulse

Crypto hustler • Market cycles explorer • Faith & finance from a front-porch philosopher

📲 Follow me on social: @grandpapulse

🐦 X (Twitter) @ grandpapulse

📺 YouTube @ grandpapulse

💬 Blurt.blog /grandpapulse

Posted Using INLEO

!LOL

lolztoken.com

But I'm clean now.

Credit: reddit

@grandpapulse, I sent you an $LOLZ on behalf of holovision.cash

(2/10)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP