FTX is The Opposite Of Bitcoin - Nayib Bukele

The total loss from the bankruptcy of FTX reached billions of dollars, including losses to FTX users. The failure of FTX users to withdraw funds was the first indication of FTX's bankruptcy. Sam Bankman-Fried is the CEO of FTX and was once revered as the next millionaire. But in reality, FTX, which is a crypto exchange and lending platform, went bankrupt.

Pic : https://www.foxbusiness.com/technology/ftx-unauthorized-transactions-crypto-reportedly-vanishes

Reuters, citing two people familiar with the matter, reported that at least $1 billion of customer funds had disappeared and that people told the news outlet that Bankman-Fried had secretly transferred $10 billion of customer funds from FTX to his trading company, Alameda Research.

Reuters reported that two people known to be involved in this matter reported that no less than $1 billion in customer funds were lost, and people told the media that Bankman-Fried, CEO of FTX, had secretly transferred $10 billion from FTX to his trading company, Alameda Research. .

Customer stupidity

There are so many cases of bankruptcy of crypto exchanges starting with the excuse of being attacked by hackers.

An administrator in the official FTX Telegram channel wrote that "FTX has been hacked."

That administrator told users not to visit the FTX site "as it might download Trojans."

This is a statement before FTX was declared bankrupt. As is customary, the bankruptcy case of the cryptocurrency centralization exchange begins with a hacker attack, after which the customer's funds are lost.

Cases like this have actually been repeated many times, but consumers have been convinced by campaigns in the media to park their money on crypto exchanges. This is a big mistake for crypto users.

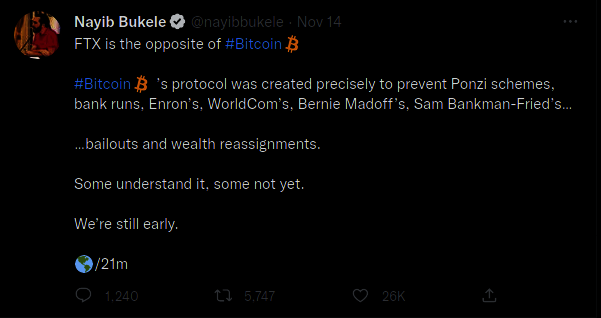

Nayib Bukele president of Elsalvador commented on the bankruptcy of FTX as opposed to Bitcoin.

FTX is a centralized exchange where users or customers do not have private keys for their crypto assets, so assets on FTX can be transferred by FTX owners themselves or by hackers who manage to break into the security of the assets.

The big case of FTX might make the crypto market crash. Bitcoin, which originally reached a price of $19,000-$20,000, has dropped to $15,000-$16,000.

Cases like this have often happened, and in 2022 they will happen again. Maybe some time in the future, similar cases will happen again because people easily forget. But for crypto investors who already understand they want a decentralized exchange because funds owned by customers cannot be transferred by crypto exchange owners or hackers unless the customer's private key is stolen.

With the FTX bankruptcy case and customer losses, do you still want to invest in cryptocurrency? If you don't understand the crypto world, don't try it!

News and image source : https://www.foxbusiness.com/technology/ftx-unauthorized-transactions-crypto-reportedly-vanishes

Berarti kudu ati- ati kuncine ya

!MEME

Credit: patlebo

Earn Crypto for your Memes @ hiveme.me!