Banks and institutions are getting ready to accept Bitcoin's as collateral

Big banks are now stepping in to backing BTC as collateral is a watershed moment, putting it on pair with traditional assets in wealth management circles. Social buzz is all about institutional flows and “store-of-value” status, but traders eye those overbought signals—MACD is bullish, yet CRSI flashes caution. The ETF is fueling this demand and most institutions wants all the Bitcoin from retails to add to their treasury

We are trying to dig into whether ETF inflows can overpower short-term profit taking? As clarity hasnt been fully enacted and nation states haven't even started to load their bags on it as a reserve currency, but with all the buzz going around no one seems too be looking at the altcoins sectors.

The long-term setup is undeniably strong, but near-term pullback risk is on the radar as volume cools and open interest dips.

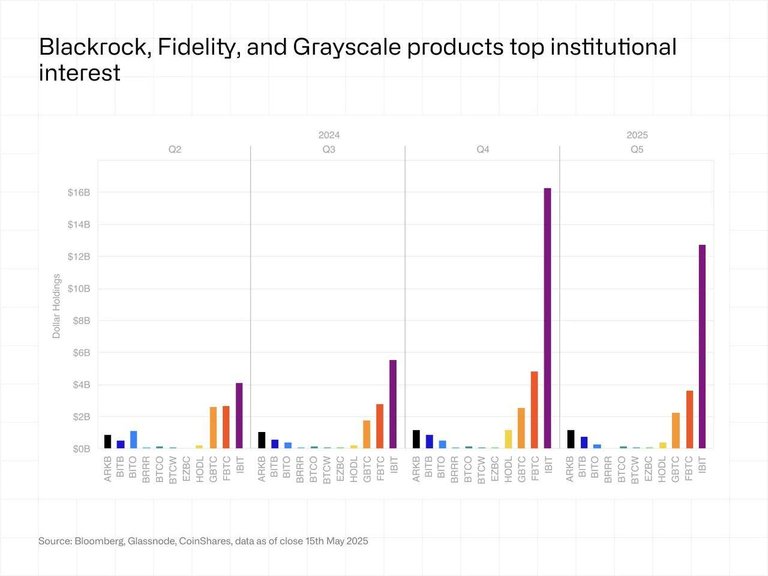

Despite a Q1 dip in holdings, 13-F filings show institutional investors are strategically rotating, not retreating, as #Bitcoin ETFs continue to attract long-term capital, led by giants like BlackRock, Goldman, and Abu Dhabi.