Decentralized finance - Real finance liberty

Are you new to crypto? Are you excited and want to know everything? Are the terminology and concepts difficult to understand? Relax, you're not the only one! However, one of the things you should know is definitely DeFi. It's the future and really, it's here!

What is DeFi in a nutshell:

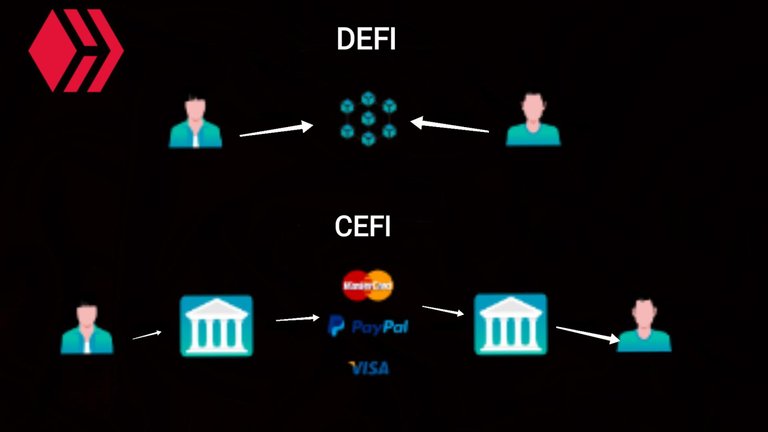

DeFi (or Decentralized Finance) and refers to the transfer of financial services & products from traditional centralized systems to Blockchain.

Its purpose is to replace the middleman who offers these products (i.e. banks) with code that runs completely decentralized, transparent and freely accessible to everyone without exception. Cool right?

This code is expressed in the form of Smart Contracts.

Imagine how you look at your computer screen shaking your head disapprovingly. Relax, more information are on the way!

The diagram below will help you to understand the difference between a decentralized way and a traditional one like that of banks

To understand the value of DeFi, we should understand the benefits it offers us!

Benefits of DeFi:

You don't need a stock trading account or credit history to use DeFi apps. You don't need a government ID. DeFi applications are publicly available on the blockchain for anyone to use without the gatekeepers you find in banks and investment firms.

This universal availability means DeFi apps could bring the benefits of financial services to unbanked people – more than 1.7 billion people in emerging economies, according to the World Bank.

With a traditional bank, some transactions take days or even weeks to clear. With DeFi, transactions are completed in minutes

Traditional banks and brokerage firms keep your money in accounts. They use your money as collateral or lend it to others and keep the interest. With DeFi, you yourself hold your own funds.

In traditional investments, you must trust the judgment of investment advisors and financial managers to handle your investments. With DeFi, you make the decisions about how your money is spent.

Banks only operate during limited hours, but the blockchain is always available.

Of course, not everything is dreamy, there are risks as in all things in our life!

DeFi risks:

- Financial Instrument Risk

This risk, quite simply, is the risk of your forecast falling out. Stocks and ETFs can move in the opposite direction to what you think, while loans can default and never be repaid.

- Counterparty Risk

The amount of counterparty risk you take on depends on how truly decentralized the DeFi protocol you choose to use is. The more centralized anything is, the more vulnerable it is to a potential digital hacking attack.

- Smart Contact Risk

Τhe code on which the blockchain is based, which in our case replaces the bank, should be perforated! Have a bug that allows someone to enter and remove the funds

- Blockchain Platform Risk

Finally, we have of course risks that may arise from the Blockchain Platform itself on which the DeFi decentralized application runs.

Conclusion

If there's one thing you should take away from this particular post, it's that the future is already here! DeFi services are growing exponentially, while the percentage of capital flowing into them is still small compared to the traditional banking system. Things do not change from one day to the next, but certainly in our days they change faster than we can perceive and describe. Banks will die and DeFi will prevail as the new king! Long live DeFi!

Posted Using LeoFinance Beta

@tipu curate

Upvoted 👌 (Mana: 8/48) Liquid rewards.

Thanks @robibasa

A good approach that speak out the standpoint of DeFi, true, DeFi is here to stay, Central system is not a match.

Thanks John! I need your feedback!

!LOL

lolztoken.com

Sigh. That's the story of my life.

Credit: reddit

@giorgakis, I sent you an $LOLZ on behalf of @holovision.cash

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(6/10)