Are We There Yet . . . . .

%20Charts%20Data%20&%20News%20-%20Yahoo%20Finance.png)

The gold mining shares have been trading sideways since my last post.

A longer term chart clearly shows the current trend of the HUI Index of gold mining stocks.

%20Charts%20Data%20&%20News%20-%20Yahoo%20Finance.png)

Always remember Rule #1 of trading or investing, and never ever forget it!

The Trend in the HUI Index is DOWN!

A downtrend is defined as a series of LOWER LOWS and LOWER HIGHS!

Rule #1 is . . . .

With that being said, the downtrend remains intact, although we could be seeing the developing of a bottoming pattern. A pattern that could lead to a change in the trend.

IF the HUI does not break the previous LOW of 172.86 posted on September 23, 2022 AND if the Bulls can rally past and sustain above the previous HIGH of 211.89 posted on October 4, 20222 then we might actually have a change in trend.

Until those two events happen the trend remains down.

So gold remains in a downtrend and closed today right smack dab on SUPPORT. If support is broken then look for gold to come tumbling down. If gold breaks down here I have a hard time seeing how the miners could put on a rally.

Silver is slightly different, in as much as silver seems to trapped in a wild but well defined range between $18 an $21 per ounce.

Overall the trend remains down however, silver seems to be holding up a little better than gold and the miners.

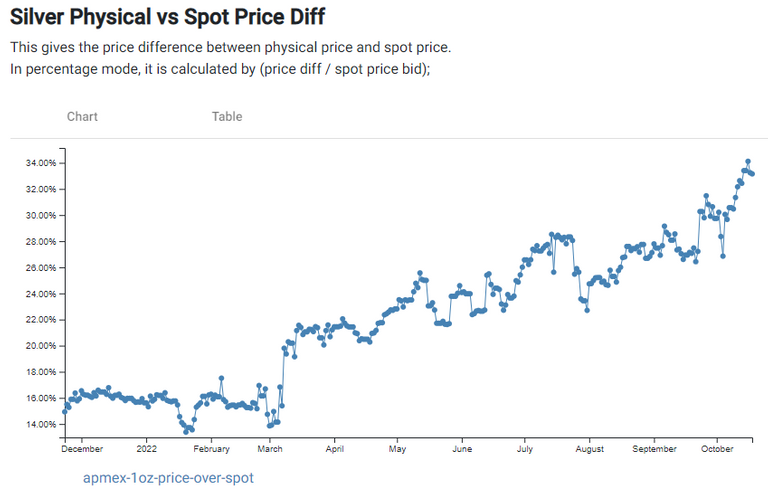

Furthermore the premiums remain wildly high on silver bullion.

source: JM Bullion

The premiums on a silver American Eagle is $18.21 over Spot Price on the COMEX Market which closed today at $18.61.

That's right you would be paying twice as much for an ounce of silver in your hands than for a Futures Contract on the COMEX for that same ounce.

Great question, too bad our dis-functional markets can't quite come up with a little something called Price Discovery!

The answer for silver seems to be somewhere around $36 per ounce if you want the real thing in your own possession.

Peace out and stack on!

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

A great analysis. The Silver Eagle premium is still high !

Stack on @handofzara !

We been going sideways for awhile now I think we are a lot more likely for a brake out than more of a down trend

I can see it now.

Spot Selling price. -$20 Paying you to take it.

Premium on Selling +$56

Price / oz. physical +$36

Buying price would be different.

Posted Using LeoFinance Beta

I think we will see more red numbers at the end of this month

!LOL

lolztoken.com

Even the cake was in tiers.

Credit: lofone

@handofzara, I sent you an $LOLZ on behalf of @holovision.cash

Have you tried the !gif !lolz !meme combo? It is a wall of fun!

(3/10)

Credit: memess

Earn Crypto for your Memes @ hiveme.me!

The rule one. Trade the trend

Quite a week for precious metals. Price should rebound sometime in the future. Till then it's about stacking and taking advantage of low prices

We're already at the point where real-world prices are nearing DOUBLE the alleged "spot" price. This trend will continue until everyone disregards "spot" and trades according to the free market. Silver @ $36 sound about right.

The premium is insane now

Source: https://silverbacksnakes.io/finance/silver

Look at the disappearing registered silver held at COMEX vaults!