Retest, False Break or On the Edge of Glory?

%20Charts%20Data%20&%20News%20-%20Yahoo%20Finance.png)

The blue line is the "break out" line for the gold mining stocks. In the past week, the HUI Index of "unhedged miners", dropped down to retest the breakout, bounced off of this line, confirming that what was once resistance is now support.

Of concern is that today, the HUI posted a slightly down bar on the same day that gold and silver both posted a very positive day.

Could be nothing or it could be something. How is that for a very definitive, yes, maybe, possibly of no way answer?

Of course, the answer is always "yes" as it always depends upon whether you are trading or investing.

Do you really trust that your brokerage firm is actually procuring your shares?

Remember that we live in very interesting times, when what was done in the dark shall be shown in the light.

Speaking of light, bright and shiny things, GOLD also retested the breakout and has thus far bounced off of its breakout. So far so good, but we are in the early stages of an uptrend when all things are still possible even a bearish reversal. If gold takes out the previous HIGH then look for another run to the upside. If however, gold takes out the prior LOW then things get real complicated.

Silver, my personal favorite, looks ready to run.

If silver takes out the prior HIGH of $23.69 then we could see some nice upside movement.

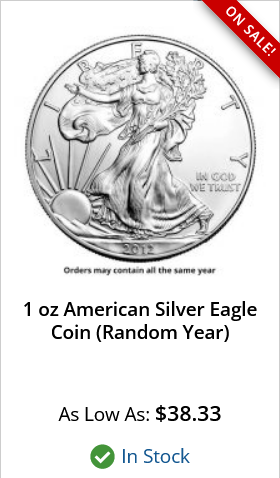

source: JM Bullion

JM Bullion is having a sale on American Silver Eagles, with a premium of only $15 and some change above COMEX Futures. Now that has come down slightly but for context the premium is still almost twice the amount as in times past.

So there you have it!

Peace Out and Stack On!

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

I remember when the premium on silver eagles was only a buck or two compared to .999 rounds. It seems to me the real price of physical silver is closer to $40 than $30.

My instincts say, Retest.

We'll probably look back a year from now and say, '$15 Premium? on any date $150 American silver Eagle? That's cheap.' 😉

Posted Using LeoFinance Beta

Ur so wrong..,.. it will be 18 months not a year 😊😊😊

I'm a Canadian living under the Castro Jr. regime so I can't help being pessimistic, or is it optimistic?🤔

A great analysis. I think that silver is due a rally !

!LOL

lolztoken.com

One, they hold the bulb while the world revolves around them.

Credit: marshmellowman

@handofzara, I sent you an $LOLZ on behalf of @holovision.cash

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(9/10)

I agree with your analysis, I think gold is just lagging behind, silver looks primed to explode

💯 agree!

We might be expecting some massive down on gold soon

“ with a premium of only $15 and some change above COMEX Futures. “ we I remember us talking about years back here. If they keep spot price down the real physical price will surge via premium. It was .79 cents in low grade rounds with max purchase and paying via check. Now it’s 60% premium. This is the real price of silver! 🪙

Thank you so much for your support of my @v4vapp proposals in the past, my previous one expired this week.

I'd be really happy if you would continue supporting my work by voting on this proposal for the next 6 months:

Additionally you can also help this work with a vote for Brianoflondon's Witness using KeyChain or HiveSigner

If you have used v4v.app I'd really like to hear your feedback, and if you haven't I'd be happy to hear why or whether there are other things you want it to do.