Surprise! Surprise – Trump Reverses Course on Tariffs... But Why?

Created using Microsoft Designer Image Generator and Canva

Hot Theme to Make Memes On – Trump Tariffs

There’s no doubt about it—anyone into making memes or comics has struck gold with the latest episode in Donald Trump’s “Tariff Series.”

I’ve personally created several memes and visuals capturing the market chaos sparked by President Trump’s aggressive tariff policy.

Created using Canva

Yes... he went all out with his harsh tariff announcements, leaving markets in flames—not just in the US, but in Japan, China, Taiwan, Europe, and beyond.

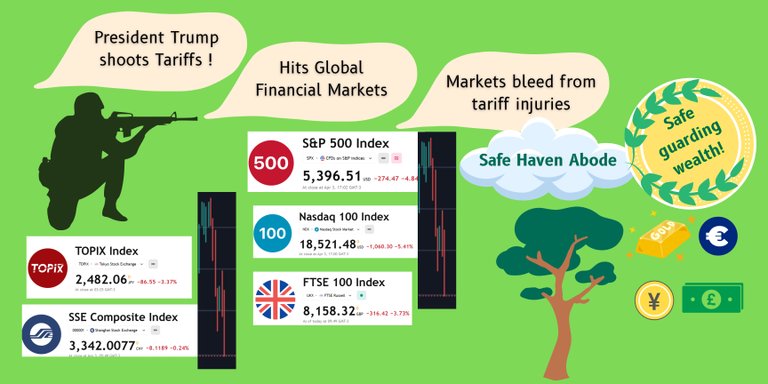

As one of my memes shows, Trump’s tariff shots have wounded global markets.

Created using Canva

His tariff punches were the nightmare scenario for economies around the world!

Created using Canva

Just yesterday, I had finished writing about the deep dive in crude oil markets—a clear sign of recession fears taking hold.

Markets in Panic Mode: Crude Oil Collapse Reflects Global Economic Jitters

The drop reflected worries about declining economic activity such as manufacturing and production, which in turn drags down the price of oil.

Created using Canva

Trump Tones It Down: A 90-Day Pause Brings Relief

Created using Microsoft Designer Image Generator and Canva

But today, the tide is turning. Markets are rallying after Trump announced a 90-day pause on his harsher tariff plans targeting trading partners.

He has now opted to impose just a 10% tariff on imports from most countries. Markets are breathing easier—green candles are back, and it feels like the sun has finally come out after the storm of Trump’s earlier aggression.

Still, the change raises eyebrows. Why the sudden shift?

While the 10% tariff remains for most countries, the 125% tariff on Chinese imports stays unchanged. In retaliation, China will slap 84% tariffs on US imports.

Trump reverses course on reciprocal tariffs, announces 90-day 'pause' for all but China

So clearly, the trade war hasn’t been called off—just dialed down for now.

The real reason behind the backpedaling? The Bond Markets.

Why the U-Turn? Clues Lie in the Bond Market Meltdown

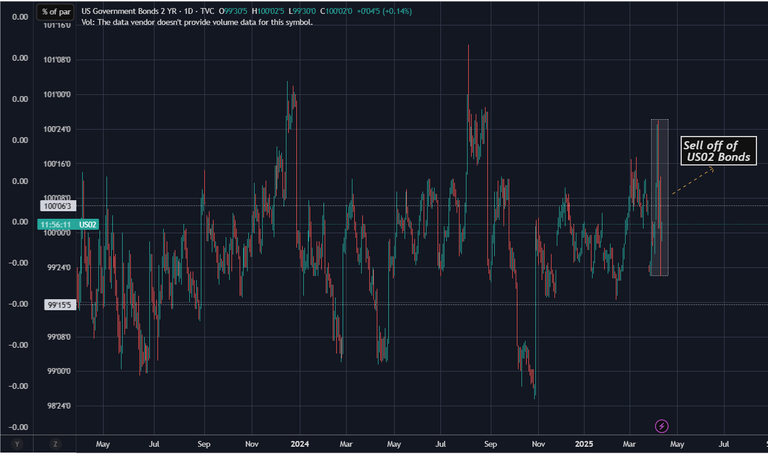

As I’ve explained in earlier posts, during economic uncertainty, investors rush to “safe haven” assets like the USD and US bonds. But lately, something’s changed—investors have been selling off US bonds.

Tradingview>>. Sell off in 2 year US Bond Market and price decline

Tradingview>>.Increase in yields from 3.45% to 4.047%

Tradingview chart>>. Sell off in 10 year US Bond Market and price decline

Tradingview>>. Increase in US 10 year Bonds from 3.8% to 4.5%.

This sell-off has caused yields on 2-year and 10-year US bonds to rise as their prices drop. That’s a warning sign: investors are losing confidence in the US economy.

Trump says 90-day pause on reciprocal tariffs for all except China

And that’s dangerous.

An escalating trade war could lead to a full-blown economic collapse. A mass bond sell-off means the US government must pay back bondholders with interest—putting more pressure on banks, the Treasury, and the entire financial system.

The risk? A bond market meltdown, followed by a banking crisis and drained USD reserves.

Faced with this ticking time bomb, Trump had to pivot.

So yes, the tariff madness has been toned down, but make no mistake—it hasn’t ended.

The meme-worthy drama continues. Stay tuned!

Posted Using INLEO

!MEME

Posted using MemeHive

Credit: antisocialist

Earn Crypto for your Memes @ HiveMe.me!