Are Ponzi scheme and Pyramid schemes are still destroying the crypto community's trust?

After the recent LUNA tragedy, many cryptos such as SOLANA, CELCIUS, and many more attacks have boomed into the crypto sphere. And every day dozens of new lending and borrowing platform are entering the market. is it good for the crypto industry? In long term it is not making the crypto sphere a convenient place at all. To understand it the famous scams in the world with the PONZI SCHEME and the PYRAMID SCHEMES are the best example to describe it.

PONZI SCHEME

A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi scheme organizers often promise to invest your money and generate high returns with little or no risk. But in many Ponzi schemes, the fraudsters do not invest the money. Instead, they use it to pay those who invested earlier and may keep some for themselves. investors.org

You can detect with the following points:

- High returns with little or no risk but it is not possible in the practical world.

- Overly consistent returns but high returns is not sustainable in any sense!

- Most of these are unregistered investments from which you can claim nothing.

- Unlicensed sellers, complex mechanisms, delays in payments are the most common issues.

And here comes the easiest way to grab more people and give the high yield to the prior members and when the scheme accumulates a lot of money then they just disappear from the sphere.

PYRAMID SCHEME

The promoter promises a high return in a short period of time. No genuine product or service is actually sold. The primary emphasis is on recruiting new participants. All pyramid schemes eventually collapse, and most investors lose their money. investors.org

So, the simple strategy is simple to spread the desirable yield rate through the social media and attract more people to take their investments and at last declare as bankrupt and vanish from the sphere. And the people bear all their life savings!

Recently, SEC Charges Eleven Individuals in $300 Million Crypto Pyramid Scheme [source]. So it is an ongoing issues to revise again in crypto industry.

So, why the good companies are also in red list while they are often lisenced in many countries like USA, Singapore, Japan, Korea or England?

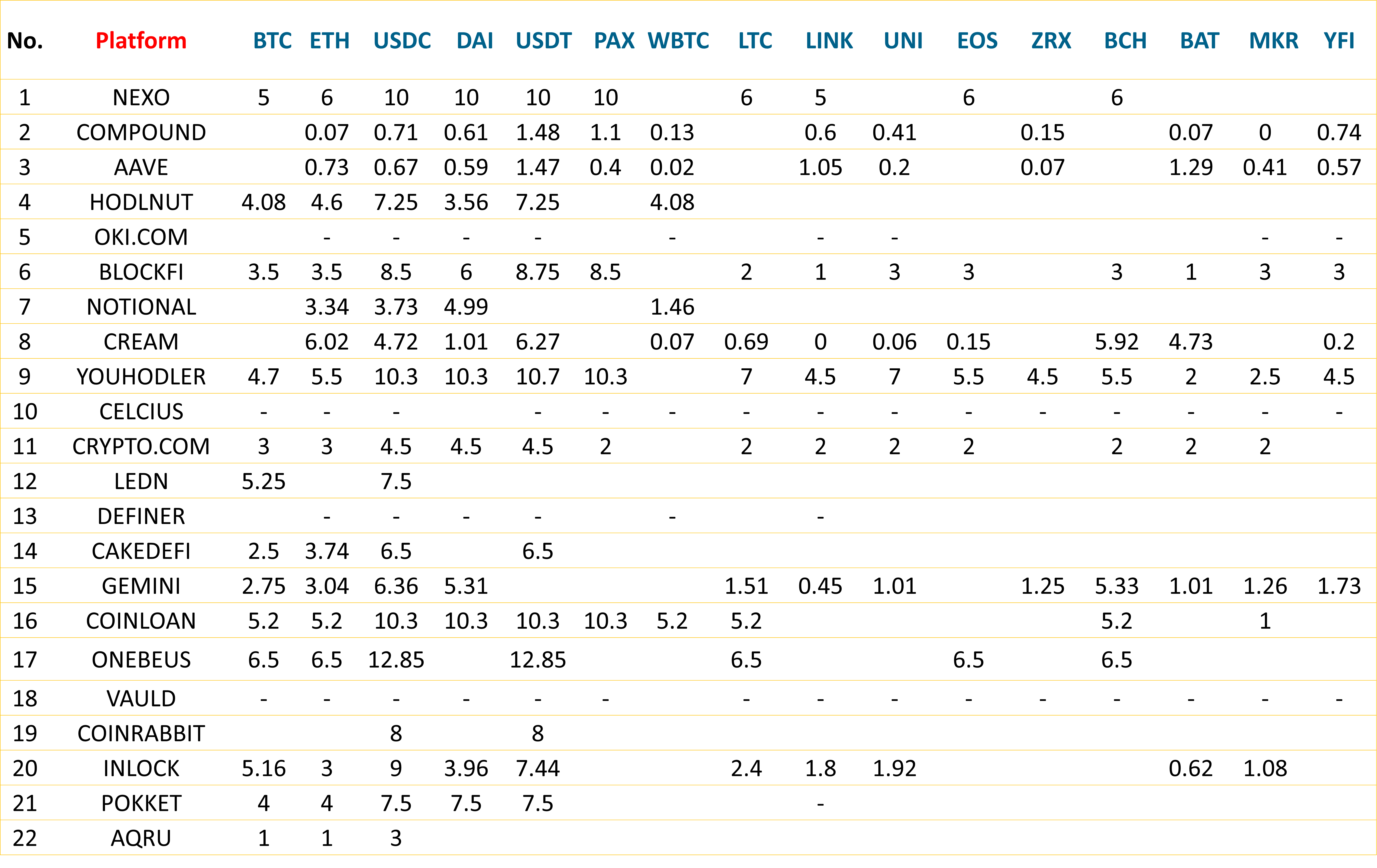

Before the answer, let's check some of these interest rates in the following figure. You can see most of these trusted ones have not too much interest rate. Even HBD has a annual yield Rate of 20%! So, why I trust the Hive blockchain, the simple question Hive is not like those blockchain where some third parties are running dappps or defi projects but HBD is integrated with the HIVE! But I cant assured the long term yilding from the Hive-based projects such as the wonderful game I always play - Splinterlands!

The interest rate has been updated from moolo.net

The currently existing registered projects are solid?

The simple answer is no, never, my answer is based on the LUNA tragedy, Celcius Scandal, Sol lend platform and some others where the company people are speculating secret data to make a huge profit. For an example, if you know that SPS is going to list in Binance next month which is still secret but as a company worker somehow you know this and let your friend to buy some coins in millions, and he can make a 400-1000% profit on the listing time which is a really modern scam story.

Let's go into the previous point, most of the DEFI projects and the Lending platform have their own secret strategy to work and maintain the high yield. But everything is smooth in the bull run cycle, and all of the systems will collapse in the bear cycle. The current tragedy in some projects is due to the bear trend in the crypto market. All want to withdraw their money and liquidate their funds. And as a result, those cryptos are going to die as the company can't buy everything by themselves as they are running the system from other people's funds. this makes sense that you can't run the high-yield farms in a bear market for a long time!

The so-called supercoin YFI touched around $95000 but what is the price now?

So, in bottom line, never trust these High Yield defi or dapps blindly keep your funds safe.

Thank you for reading my post. I will catch you at the next.

Have a nice day!

Posted Using LeoFinance Beta

https://twitter.com/tanzil2024/status/1555937932518760449

The rewards earned on this comment will go directly to the people( @tanzil2024 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

!MEME

!LOL

Credit: serhotest

Earn Crypto for your Memes @ hiveme.me!

lolztoken.com

Which is why I still live with my parents.

Credit: reddit

@tanzil2024, I sent you an $LOLZ on behalf of @holovision.cash

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(5/8)

Dear @tanzil2024 , Thank you for advice!

!PIZZA

PIZZA Holders sent $PIZZA tips in this post's comments:

@tanzil2024(1/5) tipped @goldgrifin007 (x1)

Please vote for pizza.witness!