Comparing BTC and Gold with the other Commodity Returns in last era

2023 has kicked a good start for almost the market worldwide after a long pandemic year in 2019-2020 and the post-pandemic period of 2021-2022. Now, it can be concluded that finally, we have out of the Covid-19 pandemic with the removal of all the Covid-19 related restrictions n China from 8 January 2023. And the recent pump in the markets shows the recovery and the $4000 pumps in BTC price has brought a huge possibility in the crypto space also after the devastating year of 2022!

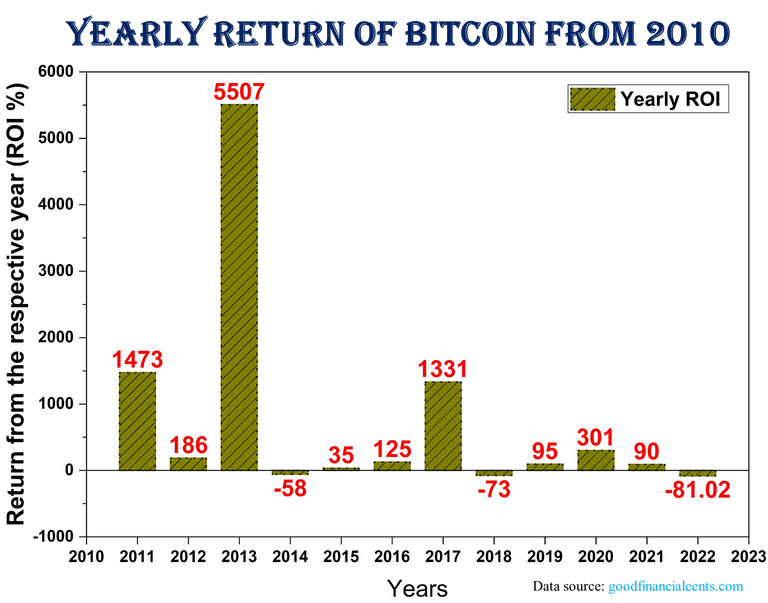

An interesting pattern that I found with the bitcoin price is the pattern, every four years it drops significantly and the dropping rate is increasing as -58%, -73%, and -81% in 2014, 2018, and 2022 respectively!

Also, the increasing ROI is also dropping dramatically according to the highest ROI in 4 years cycle. The yearly returns were 5507%, 1331%, and 301% in 2013, 2017, and 2020 respectively through massive drops in the four years cycle!

The reason behind such little volatility is indeed a good sign that will ensure the BTC is used as a great medium of storing value like other assets. And the evolution of BTC will definitely make the volatility lower in the future and also make the Crypto space a more attractive one for big investors. Also, the gambling thoughts from a group of people will fade away through such sensible sustainability in BTC price.

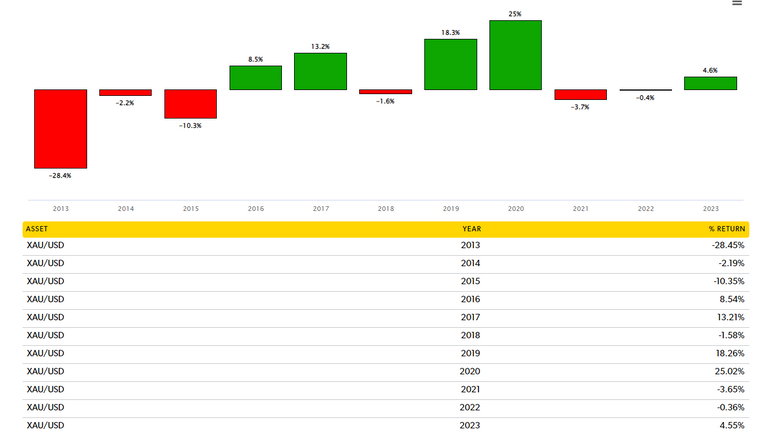

The common phenomena of economic incidents is depending on supply and demand. As a limited and stable metal, Gold is being used as a storage value from the very early history of human beings when they started doing business with other nations and countries. And still now Gold has a strong legacy in the storage of values. Gold is recently unstoppable for a couple of months and is being traded at $1910/OZ. One of the reasons behind the bullishness of the gold price is the increasing fed funds rate and the concern about the upcoming recession is still affecting the economy. And as a result, investors are finding the best place for the safety of their funds and Gold is a great option without any doubt. Gold has proved itself to be one of the most attractive assets with abundant liquidity options throughout the world with a long history of successful asset category! It is the core reason that always drives Gold to store value but currently, the price is increasing so fast due to the increasing demand.

But unfortunately, with the last era's record Gold is the best asset at all and the ROI is not satisfactorily high in the case of GOLD anymore! After the mega dump in 2013, Gold showed s3 consecutive years of loss and then surged for two years in 2016 and 2017. And with a little drop in 2018, it has surged again to the Covid-19 pandemic situation worldwide! And 2021, and 2022 are stable with no significant change in ROI but the start of 2023 is a good start.

Undoubtedly, Gold can be considered the most risk-free medium for storing the value and there will be no such volatility as the other conventional assets or the super volatile but extreme ROI provider Bitcoin and other major cryptocurrencies!

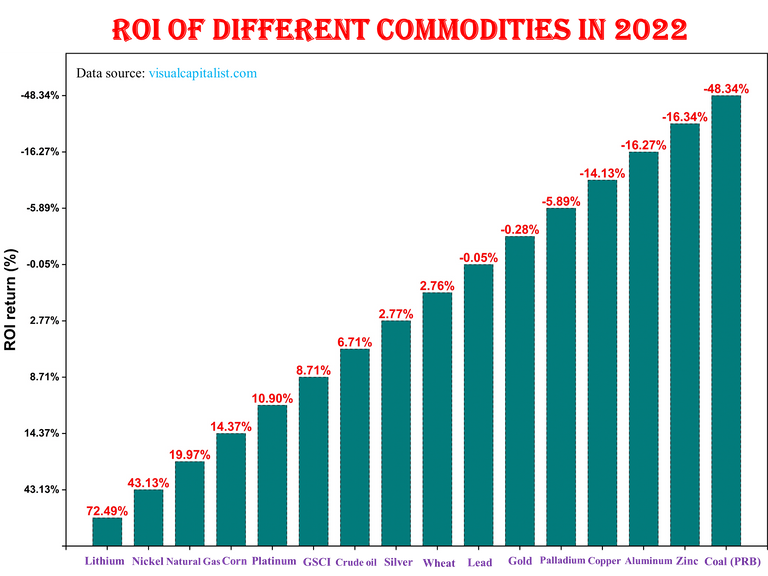

Now, let's a have look at the different commodities return in 2022 which shows the range is surprisingly too high! Very useful metals like Aluminium lost 16.27% and the energy source coal has lost 48% which is really surprising! On the other hand, Lithium and Nickel have given 72.49% and 43.13% respectively.

Also, the other energy sources like natural gas and crude oil have given positive returns with 20% and 6.71% respectively. The commodities such as food items have surged due to the Ukraine-Russia war and corn and wheat have given positive returns.

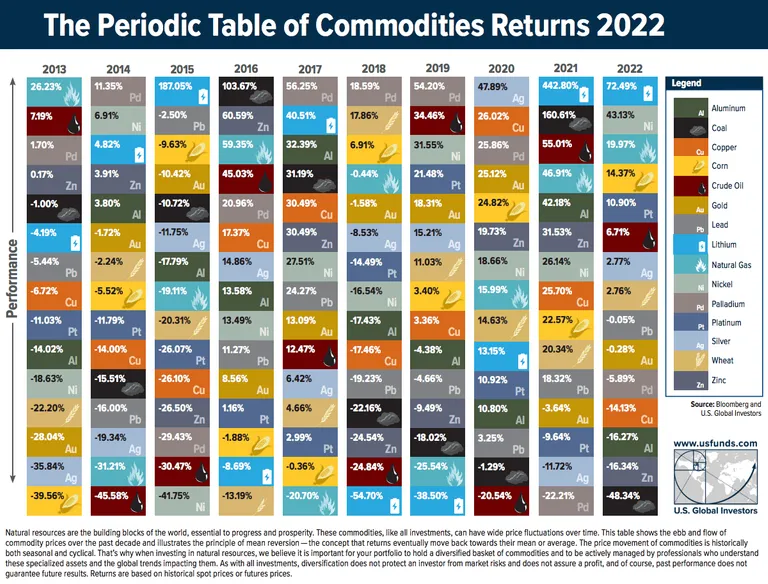

According to the last decade's ROI analysis, the most volatile assets besides cryptocurrencies are Crude oil, Coal, and Lithium. Also, normal phenomena of various assets always show ups and down in their price which is always expected. The following figure shows the overall top gainer and losers among these commodities from 2013 to 2022.

In conclusion, a group of people always criticize Bitcoin and other cryptocurrencies for extreme volatility but it is a bitter truth for many other assets also. And BTC is moving forward by decreasing the volatility and I hope the sustainable growth will make BTC more stronger in the future. Also, it is an undeniable truth that Cryptos as given the most ROI compare to any assets available in the last decade by making a ton of crypto millionaires and a number of billionaires also!

What is your thought on the BTC and GOLD performance with compare to the other assets and commodities? And what will be the future of BTC? Let us know in the comments. Thanks a lot for your time and attention in reading my food post. If you have queries regarding the post please feel free to let me know in the comment section. I will catch you at the next.

Have a nice day!

!LOL

lolztoken.com

The bartender shouts Geto out of my pub! We don’t serve your type!

Credit: ifiwasfrank

@tanzil2024, I sent you an $LOLZ on behalf of @holovision.cash

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(2/10)

I think with how volatile BTC is, gold seems to be a better option

Indeed, but the volatility of BTC is decreasing every 4 years of the cycle!

Dear @tanzil2024 !

Everyone has a dream of becoming rich.

However, I don't think there is an easy way to get rich!

My friend Hassan's argument is very interesting and tempting!

I wonder how Hassan will invest in cryptocurrency!😉

The true is what you said, there is no short-cut to be a rich man. It needs a lot of patience and hard work with making some great decisions in your financial activities.

I will never become a investor as I don't have enough money but will be a hard worker to be a rich man.

Yay! 🤗

Your content has been boosted with Ecency Points, by @tanzil2024.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Gold is more stable investment. It's less risky !