De-dollarization: why it becomes so significant worldwide?

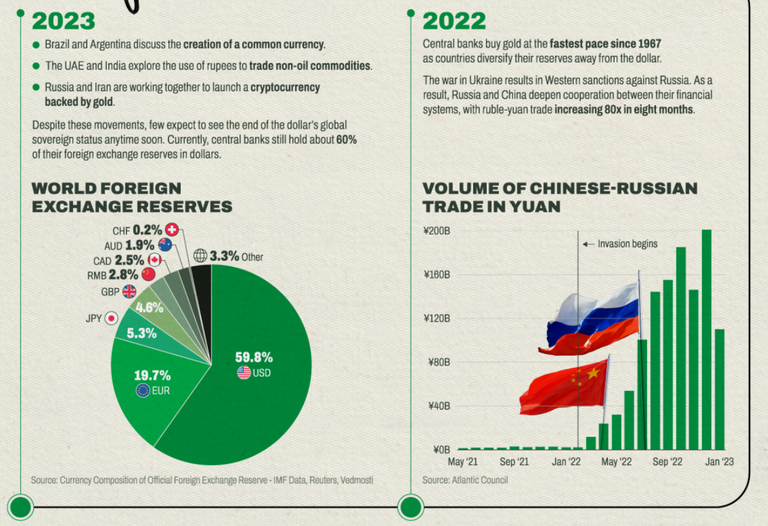

About two months ago I have discussed in my post BRICS and their new development bank and how they want to set up their own currency to get rid of from the dollar supremacy. And their goal is to create something alternative to the USD though still, USD covers more than 58% of the global foreign reserve which is not gonna plummet so soon. But the slow and steady movement by the anti-dollar sentiment is increasing so fast than expected and now it has gained more space with the recent banking sectors turbulent and the collapses of 3 renowned banks in the US.

The triggering of this will lead to a faster de-dollarization in the coming days which can eventually change the world financial system significantly. BRICS is already a giant with the most populous countries India and China having more than 36% of the world population which is the consumer market of more than one-third people of the whole world! The IMF regularly publishes the aggregated Currency Composition of Foreign Exchange Reserves (COFER) of the countries that show China has a steady growth in the amount while the other western countries are losing their share. Though it doesn't represent the de-dollarization aspects as the price of USD has gained a lot of value in the post-pandemic period instead of too much printing.

But it is also true that the whole economic system is also facing more troubles while USD gained value and the fear of recession and economic collapse is more intense which is becoming more imminent than ever. And here comes the complexity of the unemployment problems with the increasing inflation and the situation that is gonna be STAGFLATION which is considered to be a double-sided sword and even recently I come to know about the term!

Such complex economic conditions due to the pandemic have been fired up with the Russia-Ukraine war which is not going to be over soon! And the drastic sanctions and boycotting of Russia in the western world pushed up the de-dollarization faster than ever and the previously affected countries like Iran have also joined the team wholeheartedly! As a result, the gold-backed new cryptocurrency has been introduced for the Iran-Russia business which is a positive sign for blockchain technology but the fear of illicit doing through transactions is also more prominent!

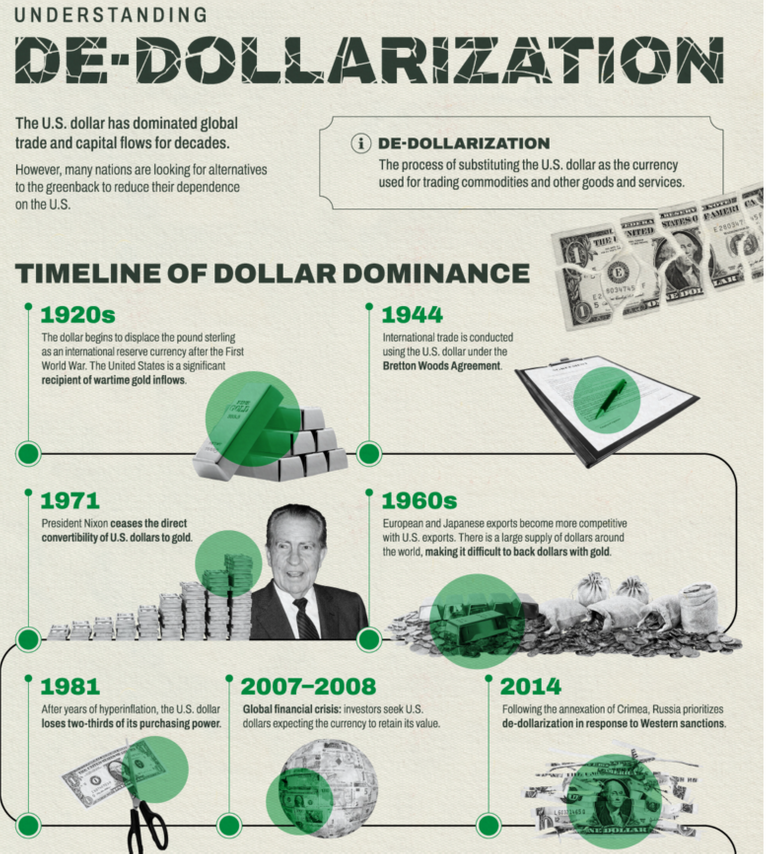

The de-dollarization process so far

De-dollarization is the process of reducing the dependency on the US dollar as the primary currency for international transactions by global companies and international entities. This is a concept that has gained momentum in recent years of the frequent sanctions and the self-supportive weapon to give punishment to those countries against the US alliance and it happened with many countries which are exploring alternative ways to trade and invest without the use of the US dollar. China, Russia, and Iran are among the nations that have made significant strides in de-dollarizing their economies for their own benefit. China has been a leader in the de-dollarization movement, with the country's government actively promoting the use of the yuan in international transactions. The yuan has already become a major currency in trade with China's Asian neighbors, and it is now being used for trade deals with other countries as well. In 2018, the yuan was included in the International Monetary Fund's (IMF) basket of reserve currencies, further bolstering its status as a global currency which is the major step in the de-dollarization process.

Russia is also actively pursuing de-dollarization, largely in response to US sanctions after the war that have targeted its economy. Prior war in 2019, Russia reduced its holdings of US Treasuries to the lowest level in over a decade, while at the same time increasing its holdings of gold. This move was seen as a way to reduce Russia's dependence on the US dollar as a means of trade and investment. Also, they have forced the EU countries to pay back their oil and gas price in Ruble which save the Ruble from a drastic fall and make it a valuable currency through this step. Iran is another country that has been hit hard by US sanctions, leading to a push for de-dollarization in the country. In 2020, Iran announced plans to create its own cryptocurrency to help facilitate trade with other countries. This move was seen as a way to bypass US sanctions and reduce Iran's reliance on the US dollar. And now they have made the tie with Russia to make their trade with gold-backed cryptocurrency. Also, Iran has been closely tied with China recently while India has lost its position in Iran recently.

But the most important thing that I observe is that India is now fueling up the de-dollarization process. The close relationship with Russia and the recent Adani scamming reports, and the BBC documentary against Prime minister Modi have forced India to be safe from dollar-based potential aggression in the near future as they are also destroying the democracy in the country with the exposition of human rights in the country. So, one of the main drivers of de-dollarization is the increased use of sanctions by the US government as a tool of foreign policy as seen against several countries worldwide and Russia is the latest one. These sanctions can have a devastating effect on a country's economy, as seen in the case of Iran and Russia. As a result, many countries are exploring ways to bypass US sanctions and reduce their reliance on the US dollar as a means of trade and investment. Another factor driving de-dollarization is the rise of China as a global economic superpower. China has been actively promoting the use of the yuan in international transactions, and its efforts have been paying off. Many countries now see the yuan as a viable alternative to the US dollar, particularly in trading activities with China. But it is also a matter that in most cases China imports less but exports many times which is not good for many countries!

There are several benefits to de-dollarization for some countries and also it can be disastrous for some economy also in the long run. For one, it can reduce a country's exposure to US economic and foreign policies that will make an impact on the measures that the western world take against some human rights violation across the world. Countries like Afghanistan will no longer lose a significant amount of money when they need it badly! This can help countries maintain their sovereignty and reduce their vulnerability to external pressures which can be sometimes intentional and a result of nasty politics. Additionally, de-dollarization can lead to a more diverse and stable global financial system, as multiple currencies are used for international transactions.

Another entity against the G7 is standing up which is also a positive thing in many senses for the stable global system as BRICS is growing faster than ever. More countries are joining them as my country Bangladesh has a little share there which is making the anti-US alliance a safe place to deal with their business in an easier way. Also, BRICS is trying to make an independent settlement system that will be a complete attachment of the US authority which is important for the existing system to compete and may bring more competition which will bring more benefits from the both systems.

Andy Schectman, CEO of Miles Franklin Precious Metals Investments, explained in a recent interview that the five leading emerging economies—Brazil, Russia, India, China, and South Africa, collectively known as BRICS nations—are “coalescing against the dollar.” Schectman believes that since 2022, de-dollarization “seems to be spinning much, much faster.” De-Dollarization and CBDCs: Monetary Historian Suggests a Great Reset Is Imminent-news.bitcoin.com

There are also potential downsides to the de-dollarization process as many countries have deep ties to the US dollar and its financial system. Additionally, de-dollarization can lead to greater fragmentation of the global financial system when different countries use different currencies for international transactions. And currently, the economic vulnerability in the US is seen with the recent collapse of the banks, the rising unemployment rate, and the fear of the recession making the economy in a risky zone for investors and the general people. And in such a situation de-dollarization adds more fire for a greater economical crisis in the world as predicted by many experts. Expert Predicts Looming Economic Collapse as BRICS Nations Unite Against the Dollar

In conclusion, de-dollarization is not a new concept that is gaining momentum around the world from a very early stage of the emerging dollar supremacy, particularly in countries that have been hit hard by US sanctions, pressures, and some issues with their foreign policies. China, Russia, and Iran are among the countries that have made significant strides in reducing their dependence on the US dollar. What are your thoughts about my points if you think some are missing here or some need to be revised or on which point I am wrong, please feel free to leave a comment which will help to know these together.

Thank you so much for your time and attention in reading my post! Enjoy your every day in the best way you can. I will catch you at the next one!

Have a nice day!

https://twitter.com/1517865371864293376/status/1640605794587787265

https://twitter.com/1442409163926081537/status/1640611619754369025

The rewards earned on this comment will go directly to the people( @tanzil2024, @doomz ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

!LOL

lolztoken.com

The stock market.

Credit: reddit

@tanzil2024, I sent you an $LOLZ on behalf of @holovision.cash

(2/10)

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

I mentioned on Leo Threads yesterday that it seems de-dollarization has been accelerating as of late. News of Iran, Iraq, Saudi Arabia, Russia, and more recently Kenya dropping the dollar in favor of other fiat (or crypto) currencies is popping up more frequently. It's also interesting that both CNN and Fox covered this topic over the weekend...

Covid presented an opportunity for a "Great Reset". An insane amount of money was printed during the covid lockdowns to bailout the consumer, followed by a rapid rise in interest rates to combat the inflation. Nations, corporations and individuals that binged on cheap credit over the past decade can't handle the pressure of 5% interest rates.

Whether intentional or not, it would seem more people are waking up to the fact that the US dollar is on its last legs, and could drop precipitously in value in the near future. If the panic spreads, it could lose value much faster than anticipated.

Yeah, a global reset is inevitable as Covid-19 has made it faster than thought, but I think the reset will not create any Dollar supremacy as it is now, the reset will more diverse and there will be nothing like the USD as it is in such a gigantic form.

I don't think such enormous collapse will trigger as Dollar is still the main reserve for the BRICS countries also like China has may be more than 3 trillion as I remember, such a loss will not be there in my concern but slowly the value will decrease as the ultimate result of the global reset.

Thanks for stopping by!

Curated 🚀

Thanks!

"as-salaam 'alaykum" @tanzil2024!

Do you believe that de-dollarization will benefit the countries of the Indian subcontinent, the Middle East and Russia, china?

"Wa-alai-kumus-salam" dear @goldgrifin007!

I don't think for India or China it is a big deal until they have the lowest earning from the western world as they still earned a lot from the west but for countries like Iran, Russia, and Middle East, it will be completely Devine for violating more human rights and the MAFIASM will be prominent in that region. That's my point of view regarding the de-dollarization.

Dear Hassan!

I don't use cryptocurrencies, so I don't know how dedollarization will affect me.

So, it's hard to understand your argument.

You need notbto understand in the case unless you have interest in economic space. Even for me, no impact either as I am not an investor.

Yay! 🤗

Your content has been boosted with Ecency Points, by @tanzil2024.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more