Reward from ZING staking or liquidity pool?

Greetings to all of my dear friends in the Hive Universe. I hope all of you are doing great. The brand-new roleplaying game Holozing has just recently launched has great attention from the Hive community. Due to the incredibly high returns on the game's token, ZING, Holozing has emerged as the most ambitious game in the Hive Universe at the moment. After around two weeks of my experience, I am going to talk about the most confusing part of the reward mechanism through the staking ZING and by providing the liquidity pool and give my own opinion regarding my thoughts at the end.

Before starting I want to make my standing about the future of the game. I am very confident about the bright future of the game without any doubt. Due to higher rewards, many have many people have invested a large portion of their HP in the game for a short time, but individuals appear to be highly eager about this game and the rising attention of the holozing community among the community members in the Hive universe is really amazing. I can remember that very few games that were recently introduced were able to grab such attention within a few days.

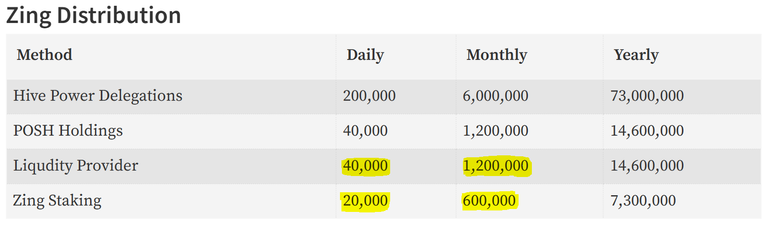

And be sure that there are other two available methods which are the HP delegation and the POSH holding, and both of them are amazing but completely different as there are no issue with the liquid ZING rewards which are being involved in the stacking and liquidity pool rewards with direct connection to the market manipulation.

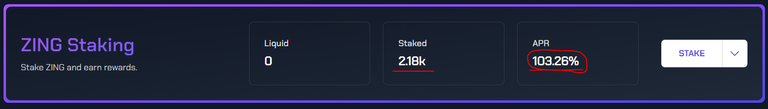

ZING stacking

This is the most stable way of earning ZING tokens for now and for the future as it is the main currency of the game, but the APR is much lower than the other available options, it is a great idea to grow your portfolio and make your idle ZING work for you. The great future of the game will bring more use cases that can make the token more expensive in the future.

This one is the most flexible and hassle-free way of generating rewards in a stable way. The long-term stacking will bring tremendous rewards in the long run. Though the increasing ZING supply is decreasing the reward APR the whole future of the game will be mostly affected by the impact of this mechanism.

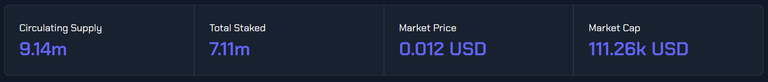

And that's why, the overall stat shows that 7.11 million ZING is staked from a total supply of 9.14 million ZING at an APR of 103.26%. Also, I am staking all of my rewards here for a potential good return in the long run without any hassle. And I am getting around 4-6 ZING every day from my stacking of 2k ZING.

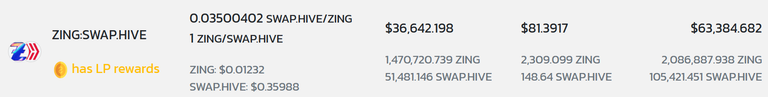

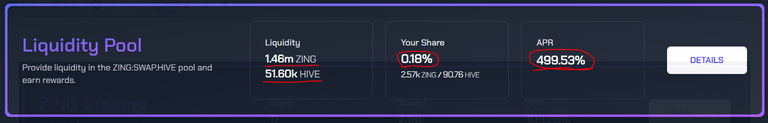

Insane Liquidity pool

In addition to being the first liquidity pair for the $ZING Token, this pair is creating a lot of buzz since a HUGE reward pool was established for each member who provided liquidity. The annual percentage rate (APR) is now about 500%. And the liquidity pool is increasing every day for so high returns.

Though the return is so high in the liquidity pool initially the rate decreases abruptly as time goes on. Also, there is the loss known as the impermanent loss when there is a significant loss in the price of any of them. More details of the impermanent loss can be found in the following post-

https://hive.blog/hive-167922/@libertycrypto27/holozing-focus-on-zingswaphive-liquidity-pool-impermanent-loss-explanation-and-examples-my-lp-investment-analysis-engita

With my tiny liquidity pool of around 0.18%, I am getting around 70 ZING which is a really amazing return for current days. However, the potential risk about the price is uncertain which will be more severe as the APR will go down in sub hundred range. Within a couple of weeks, the APR has plummeted to 500 ranging from 1500 which will go down more faster as more people enter the race.

Which way to move

I think after the discussion above, the real question is which reward pool is the best one to consider between the stacking or the liquidity provided? In terms of the APR, liquidity pool rewards are the most attractive but the staking reward is almost 4 times less than the prior one.

Still, there are some real facts that should be considered before being involved in any one of them to grab rewards in an effective way.

Rushing towards any one of these is not a good way to invest anything. So proper study and potential risks must be realized with proper calculation

The staking rewards are going to be more stable with the passage of time but the APR of the liquidity pool is going to be very unstable while dealing with the impermanent loss in an unstable market.

Staking reward is a long-lasting one where the APR with liquidity pool can be potentially loss in adverse market situations while removing your liquidity in an emergency.

The future impact of the staking ZING will make the game better with a bright future but the short-term liquidity providing can affect the game negatively.

For being in the initial days, both ways are so amazing in current days so any one of them is really amazing, so for current days, no need to think too much before investing in any option from the Holozing.

So, my final saying is to grab as many options as possible currently to grow the portfolio. My suggestion is to involve your all assets according to the risk factor though there is no possibility of loss at least I the rest of 2023. And for 2024, the bull season is coming, so nothing to be worried about here.

So, what is your plan regarding Holozing? Why make it late? jump into it before so late and be ready for the future explosion of the game. If you have any questions or info about my thoughts. please let us know in the comments, it will help us in mutual growth. Thank you for your time and attention.

Have a nice day.

All the images have been taken or reproduced from the Holozing resources.

!LOL

lolztoken.com

Diner-saurs.

Credit: reddit

@tanzil2024, I sent you an $LOLZ on behalf of holovision.cash

(2/10)

ENTER @WIN.HIVE'S DAILY DRAW AND WIN HIVE!