The crisis of strong hands in crypto space

The turbulence in the crypto space is a normal matter from the very beginning of the sphere. The more people are engaging the more versatility is being noticed and the predictable occurrences are squeezing. The easiest happening in the space is the price volatility that can still follow the same pattern to make ordinary people suffer. It is the number one technology to make you lose money without any hope and sustainability. The confusing scenario comes when we think about the existing economic model and the crypto universe. The most common phenomenon that we know is the supply and demand relation which needs to be revised when you consider about the happening in the crypto space.

The pathetic fact is that many people enter into the space only for trading like gambling here and lose their funds as a naive traders. Crypto has already gained the interest of individual and institutional investors worldwide, fueling demand with greater media coverage, investment "experts," and business owners promoting the worth of blockchains and cryptocurrencies today and in the future. Bitcoin has also gained popularity in nations with significant inflation and depreciated currencies, such as Venezuela as a great tool to overcome its US sanctions.

It is also popular among individuals who use it to transfer big quantities of money for illegitimate and unlawful purposes such as third world countries like Bangladesh, India, or Pakistan where I belong and I have the practical knowledge. The wicked people are getting the full-fledged opportunity of the weak financial systems and moderation through such privacy-oriented and anonymous transactions every day.

This suggests that a decrease in future supply has coincided with an increase in demand, causing prices to rise. However, the price of all cryptos is not going to be sustained through constant growth but continued swing between booms and crashes. For example, a surge in bitcoin prices in 2017 was followed by a huge drop, followed by two rapid spikes and drops until 2021. In 2024, its price skyrocketed to more than $75,000 on one platform, as the Securities and Platform Commission authorized multiple Bitcoin Spot ETFs, resulting in a rise in demand.

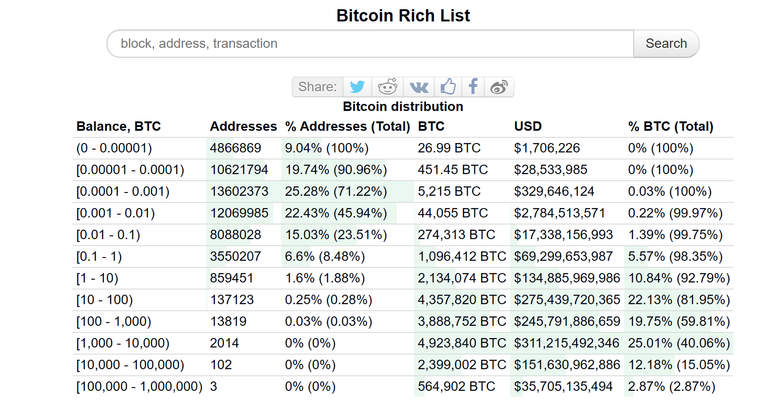

But the question arises, how far it can go? And what is the percentage of cryptocurrencies that BTC owners own how many percentage of the total coins? It is really interesting and more and more coins are still in the accumulation phase to the stronger hands in every cycle of bull and bear.

If we see the rich list of the bitcoin, then we can observe that around 60% of the total coins are accumulated among only 16000 owners! And another 33% belongs to only 1M owners. Then total of 93% of Bitcoins are accumulated among these 1M users, and the rest of the people of the earth can never earn a single BTC!

So, how much intriguingly concentrated ownership of an asset can change the future of the world?

The question is really an important factor in determining the future of BTC and the other ALTs. The Concentrated BTC asset is another region in which people need many alternatives and more diverse distribution.

Among the top holders of the BTC, most of them are very early adopters when BTC was under 1K and the time has passed forever with such opportunities. Rather than the increasing supply, the number of BTC is decreasing drastically after the recent halving event, and the whole world of crypto is waiting for a massive bull season ahead.

It is also clear from the dominance chart that for every bull cycle the price of the BTC is attacked and gradually it is going to shrink over time. The 90% dominance range in 2013 became 80% around 2015/2016 and came to around 35% in the bull cycle of 2017 in the history. Currently, it is more powerful due to the major adoption in the BTC and the running bear market that is waiting for the next bull cycle.

https://img.inleo.io/DQmYc3BTbp7FyM2VcwwYwuYbq3Sz3pubGLJJ2JE67GigEdp/bitcoin-dominance_(Coinmarketcap).jpeg source

So, the expansion of the cryptos is inevitable and the opportunity for BTC is less than some good projects in the coming days. For example, shit coins have gained massive gains in recent days, DOGE, SHIB, PEPE, WIF, and many others that reflect the power of social media coverage and the hype of getting quick money to make the common people fool again and again.

I know some people who have bought DOGE for around 50 cents and waiting for the price to climb up again which is just like a daydream. The coin without any use cases, future development, and unlimited supply cannot be a good choice in any case, but it still stands at the very top position. Even many meme coins are in the top 100 which are just like DOGE coins and have no future in my opinion.

In conclusion, the crypto space is still under reformation until there is a stable distribution of assets and owners have good faith in the project. Until most people are getting out of the common concept of 'TRADE ONLY ASSET', the sector can not evolve as the blockchain expects. But it is also a fact that the turbulence in space will cause people to lose their life savings!

Thanks for your time and attention, hope to catch you at the next.

Have a nice day!

Posted Using InLeo Alpha

Congratulations @tanzil2024! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 750 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Dear @tanzil2024 !

My bro Hassan!

Do you mean that you can gain profit and stability in cryptocurrency trading by comparing the value and trading volume of Bitcoin and other cryptocurrencies?

Yeah, many people are doing trading for that but it is very risky than other kinds of trading options as well. Whales can control the market by manipulation that makes big turbulence in the market which should be kept in mind for future trading.

Dear Hassan!

Are you saying we should always be watching the whales that own 60% of the world's cryptocurrencies?😦

Sure we should try to learn their way in trading and those movements can make you a good trader!

"as-salaam 'alaykum"! Hassan!

Thank you for kind answer!

You must be a genius because you can easily explain things to East Asians like me who are not good at English!😄

Many Japanese and Koreans claim that people from the Indian subcontinent have a natural talent for mathematics!

Well, I am attracted to the charms of women from the Indian subcontinent!😄

My pleasure!

Indian women are also very talented !

I hope you find some great Indian women when you come to visit the Indian sub continent.

!MEME

Credit: filosof103

Earn Crypto for your Memes @ HiveMe.me!