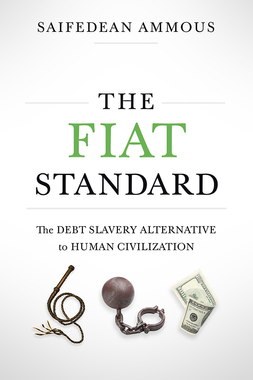

Saifedean Ammous - The Fiat Standard

| Dear Hiveans | Liebe Hiver | Queridos Hiveanos |

|---|---|---|

| Today I'd like to share my favourite excerpts from the book "The Fiat Standard" (goodreads) by Saifedean Ammous, who is an author and economist, famous for his book "The Bitcoin Standard". | Heute meine Lieblingsauszüge aus dem Buch "The Fiat Standard" (goodreads) von Saifedean Ammous, einem Autor und Wirtschaftswissenschaftler, der für sein Buch "The Bitcoin Standard" bekannt ist. | Hoy me gustaría compartir mis extractos favoritos del libro "The Fiat Standard" (goodreads) de Saifedean Ammous, autor y economista, famoso por su libro "The Bitcoin Standard". |

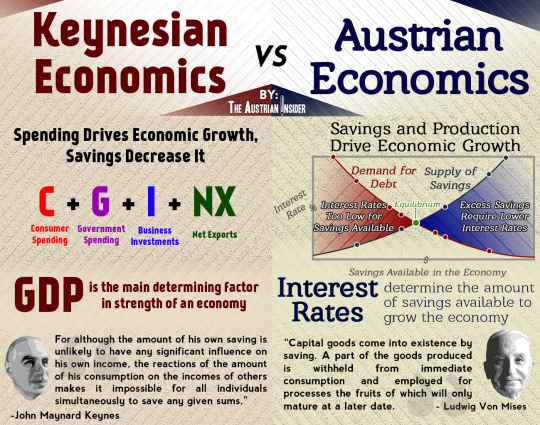

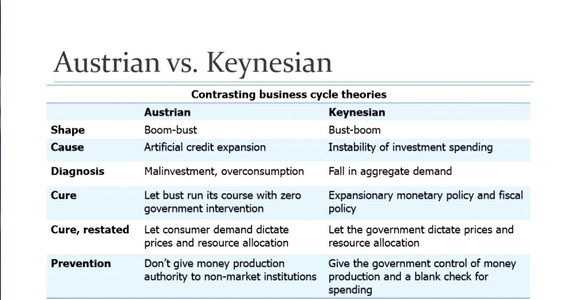

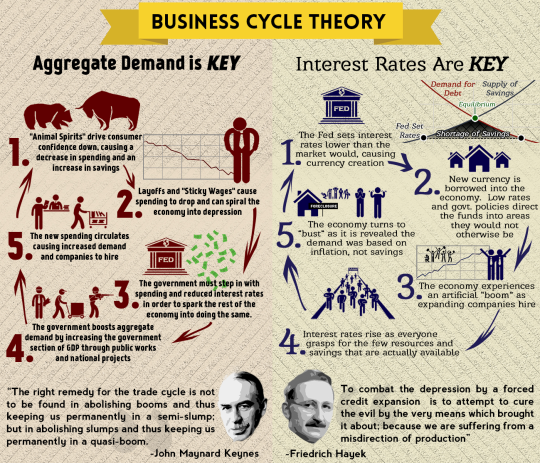

The dissaving is not just reflected in the negative fiat balances everyone keeps. It pervades across all forms of capital. Temporally and cognitively, saving is the necessary predecessor to investment and capital accumulation. Individuals have to first decide to defer gratification and delay consumption, in other words, they have to save before they are able to accumulate any capital. Capital can only be obtained from utilizing economic goods which were not consumed first, i.e. savings. The reduction in the incentive to save will lead to the reduction in the availability of capital for investing. Fiat enthusiasts will respond to this point by arguing that the inflation creates a stronger incentive to invest, and central bank credit expansion amplifies the incentive to engage in productive business rather than hoard cash unproductively. But if we understand saving as the necessary prelude to investing, then the reduction in savings will lead to a reduction in real investments backed by real savings. The investments financed through credit expansion without requisite savings are not a free gift from government that allows us higher productivity without sacrifice; they are simply miscalculations that lead to business cycles and inflation.

[...] central bank manipulation of its monopoly currency leads to distorting the ability of entrepreneurs to perform economic calculation, leading to systematic errors in allocation of capital, which are exposed when credit expansion recedes, leading to the recessionary bust part of the business cycle. Each such business cycle causes large amounts of misallocation of capital into unprofitable and unproductive ventures that effectively consume capital rather than increase it. Credit unbacked by savings cannot generate new capital for investment, it can only misallocate existing capital to sectors where the action of self-interested individuals in a free market would not have allocated it.

- Great points.

Fiat's consumptive and destructive impetus is also reflected on natural capital, and the environment in which humans live. As the possibility of providing for the future becomes less certain, because of the dysfunctional money's inability to maintain value, the long-term value of utility provided from goods is discounted more heavily. The future services provided by soil, rivers, forests, beaches, and water aquifers are discounted more heavily, making depleting these resources a more likely rational strategy. The desire to conserve these parts of nature wanes when individuals do not value their future services, and the inevitable outcome is depletion and overuse.

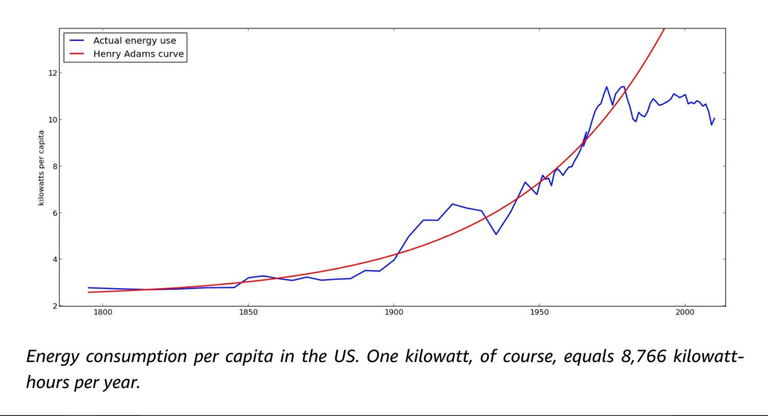

In his book Where Is My Flying Car? A Memoir of Future Past, J Storrs Hall finds a steady trend stretching for three centuries, of usable energy growing at about 7%/ year, which can be approximated as a result of 2% increase in energy efficiency, 3% population growth, and 2% growth in actual energy consumed per capita. The growth in energy consumption per capita at 2% is a relationship that held since the beginning of the 19th century, with the beginning of the utilization of fossil fuels, until the 1970s. The material of this chapter can go a long way toward explaining why the growth in per capita energy consumption stopped rising in the past 50 years. With inflation causing the prices of energy to rise, individuals had to economize and consume less energy, and the development of modern technologies that are highly energy intensive

subsided.

- That red line is the modelled energy use. I hope humankind will get back on the red trajectory.

source

source

Given the high costs of transporting and storing energy, energy production leads to very large quantities of energy getting lost in the attempt to move from demand to supply. In 2019, the world produced around 173,000 TWh in 2019. Around a third of that energy is wasted, leaving humanity to consume around 117,000 TWH. The entirety of the bitcoin network currently consumes around 120TWh, or 0.1% of the total energy wasted in the world. Bitcoin could grow 1,000 fold and still not consume more energy than humanity has wasted. Bitcoin will continue to grow by consuming this energy, primarily, because this energy has a zero opportunity cost, and no other potential buyer but bitcoin. All other electricity which has demand will find a higher bidder than the bitcoin network, because the bitcoin network can buy the cheap electricity at prices unavailable to those who need valuable electricity near large demand.

The essential property of capital goods is that they increase the marginal productivity of the producers who uses them. The fisherman who catches fish with a modern trawler has a much higher hourly productivity than the fisherman using a little boat and net, whose productivity is in turn higher than that of the fisherman on the coast holding a fishing rod, whose productivity is higher than anyone trying to catch fish with their own hands. As the stock of capital increases, the marginal productivity of the worker increases, and that is why countries that have higher capital stocks have higher income than poorer countries. The march of human progress and civilization is the march of capital being accumulated to produce more output per unit of effort expended by a human being, and the more capital is accumulated, the more productive humans are, and the lower the marginal cost of the good produced.

As mentioned above, energy on this globe is not a fixed stock which we slowly deplete, but rather an ever-renewing flow from which we only need to utilize a tiny fraction to thrive. As such, more capital investment in energy production will only lead to more capital dedicated to the utilization of these vast resources of energy, more energy production, and lower energy cost.

Applying this analysis to the question of bitcoin power consumption has startling implications. Bitcoin isn’t “consuming” the world’s energy, bitcoin is providing a powerful market incentive to energy producers worldwide to increase their energy production. By giving a large financial incentive to anyone able to mine at an electricity cost below that of the market, Bitcoin makes the development of cheap reliable sources of electricity, anywhere in the world, very rewarding. This financial reward in turn leads to growing investment in capital infrastructure for cheap energy sources, which leads to increased energy production, and decreased cost.

- 👍

The growth of bitcoin is the monetization of a digital commodity produced from electricity, and growth in demand for bitcoin will result in growth in demand for electricity. The full extent of the powerful upgrade that bitcoin represents becomes apparent when one realizes bitcoin's monetization will drive the production of electric power, one of the most important economic goods humans ever invented, while replacing the fiat monetary system which monetizes debt and government fiat, driving the growth of indebtedness and government power. Rather than direct the benefits of seigniorage to governments, bureaucracies, lenders and borrowers, and belligerent militaries bitcoin directs it to the production of the miraculous commodity that has allowed man to prosper and conquer darkness, cold, disease, and the violence of nature.

Understanding how difficulty adjustment allows only the cheapest energy sources to succeed at bitcoin mining explains why mining will inevitably be overwhelmingly sourced from waste, stranded, and otherwise unusable energy sources. The total amount of methane that is flared and burned away every year contains 1,500 TWh of energy, which is around 10 times larger than the consumption of the bitcoin network. Hydroelectric energy alone produced 4,306 TWh in 2019, or more than 30 times what bitcoin consumes. With bitcoin allowing for the building of hydropower plants in areas unconnected to major grids and population centers, the generation capacity of hydropower can increase much further. With spare nuclear capacity, as well as back-up and spare capacity in hydrocarbon-powered plants, there is an enormous room for bitcoin to grow purely on spare capacity, wasted, and stranded energy sources, at very low costs.

Electricity cost

The amount of energy that Bitcoin consumes can theoretically be estimated from its hashrate, or direct output of the energy consumption of the machines that secure the network. The machines that mine bitcoin have known specifications in terms of how much electricity they consume, and how many hashes they can produce. The bitcoin hashrate can be estimated from the difficulty and the block time. The hashrate and some reasonable assumptions of the composition of bitcoin mining equipment can give us a good idea of how much electricity is used by the bitcoin network at any point in time. Current best estimates put bitcoin's energy consumption somewhere in the range of 100-150 TWh/year. This is an enormous amount of energy, and the fact that it is deployed voluntarily is a testament to the amount of value people place on the network and its assets.

[...] the vast majority of this energy is energy that would otherwise have been wasted. It is almost always electricity that's very cheap by international standards, probably in the range of 2-5c/kWh. At that cost, and at its current hashrate, bitcoin is likely consuming $2-$6/year worth of electricity, most of which would not have been usable for any other uses. By being able to buy electricity anywhere, and by allowing only the most profitable miners to survive, bitcoin only buys the cheapest electricity and does not compete for the expensive sources near population centers.

In 2019, total global broad money supply stood at around $95 trillion, while total global wealth was around $360 trillion, meaning money constituted 26.3% of humanity's wealth. For a nice round number, we can estimate that a quarter of humanity's wealth is held in fiat money, and as that is being debased by 10% every year, humanity is losing 2.5% of its wealth every year due to the leakage of value from its liquid assets.

| Is global fiat money really debased by 10% every year? I doubt it. | Wird das weltweite Fiatgeld wirklich jedes Jahr um 10 % entwertet? Ich bezweifle es. | ¿Se devalúa realmente el dinero fiat mundial un 10% cada año? Lo dudo. |

As it stands, bitcoin's role as cash has a very large total addressable market. The world has around $90 trillion of broad government supply, $90 trillion of sovereign bonds, $40 trillion of corporate bonds, and $10 trillion of gold. Bitcoin can ostensibly replace all of these assets on balance sheets, which would be a total addressable market cap of $230 trillion. At the time of writing, bitcoin's market capitalization is around $700 billion, or around 0.3% of its total addressable market.

| I found that book quite good, but not as good as Ammous' first book "The Bitcoin Standard". Currently I am reading Lyn Alden's "Broken Money" which I'll write about next week. | Ich fand dieses Buch ganz gut, aber nicht so gut wie Ammous' erstes Buch "The Bitcoin Standard". Derzeit lese ich Lyn Aldens "Broken Money", über das ich nächste Woche schreiben werde. | Encontré ese libro fácilmente legible, pero no tan bueno como el primer libro de Ammous "The Bitcoin Standard". Actualmente estoy leyendo "Broken Money" de Lyn Alden, sobre el que escribiré la semana que viene. |

Have a great day,

zuerich

!WITZ

lolztoken.com

mein Auge tut beim Frühstücken immer so weh., Doktor: Nehmen Sie beim nächsten Mal den Löffel aus der Kaffeetasse.

Credit: chaosmagic23

@zuerich, ich habe dir im Namen von @thedrummerboy einen $LOLZ Token gesendet

Verwende den Befehl !WITZ oder !LOOL, um einen Witz und ein $LOLZ zu teilen.

.(4/10)

Congratulations @zuerich! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 58000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

!LOL

lolztoken.com

Betray'all!

Credit: reddit

@zuerich, I sent you an $LOLZ on behalf of holovision.cash

(3/10)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

lolztoken.com

To get some !HH Tokens!

Thanks for supporting the LOLZ Project.

🚀 Henthusiast Tip Incoming! 🚀

5.0 $HH sent to:

@holovision.cash and @lolz.haven

@lolz.haven has used 2 of 5 tips today.

🌄 Good morning! ☕

What?! You mean I can't have something for nothing? 🙄 Ohhhh, I don't like the sounds of that at all ... 😉

Seriously, I enjoyed reading through your excerpts. Interesting transition from the uhhh ... "fundamentals" ... of the Austrian school of economics to the discussion about what role Bitcoin might play in our future ...

Thanks for sharing this with us! 👍

The fact that bitcoin isn’t consuming electricity, and the still not even taking about more than 7 times of the electricity that waste year then. It is so glaring that the bitcoin is a business that is incentive well enough and there is a place in these article that states that when the number of sales of the goods increases the number of the productive will surely increase too and which give room for well and stable income for both party and bitcoin is really doing this, the community and network that bitcoin have provided is just too futuristic not to believe in it or start doubting it. I just wish an innovation like this can come up in most of our infrastructures. Thanks for sharing this.