Sidney Homer, Richard Sylla - A History of Interest Rates, part I

| Dear Hiveans | Liebe Hiver | Queridos Hiveanos |

|---|---|---|

| Today I'd like to share my favourite excerpts from the book "A History of Interest Rates" (goodreads) by Sidney Homer and Richard Sylla. Homer (1903-1983) was a limited partner in Salomon Brothers and was the general partner in charge of the firm's bond market research department. He is best known for his pioneering and analytical works of bond market history. Sylla is chairman of the board of trustees of the Museum of American Finance, was a Professor of the History of Financial Institutions and Markets (wiki). | Heute meine Lieblingsauszüge aus dem Buch "A History of Interest Rates" (goodreads) von Sidney Homer und Richard Sylla. Homer (1903-1983) war Kommanditist bei Salomon Brothers und leitete als Komplementär die Abteilung für Anleihemarktforschung des Unternehmens. Er ist für seine analytischen Arbeiten zur Geschichte des Anleihemarktes bekannt. Sylla ist Vorsitzender des Kuratoriums des Museum of American Finance und war Professor für die Geschichte der Finanzinstitute und -märkte (wiki). | Hoy mis extractos favoritos del libro "A History of Interest Rates" (goodreads) de Sidney Homer y Richard Sylla. Homer (1903-1983) fue socio comanditario de Salomon Brothers y socio general a cargo del departamento de investigación del mercado de bonos de la empresa. Es conocido sobre todo por sus trabajos analíticos sobre la historia del mercado de bonos. Sylla es presidente del consejo de administración del Museo de Finanzas Estadounidenses y fue catedrático de Historia de las Instituciones y Mercados Financieros (wiki). |

| This was a long read, with many, many, many tables and charts, an incredible amount of details. With my excerpts, I focus on older history, as the 20th century is rather well-known. | Das war eine lange Lektüre, mit unzähligen Tabellen und Diagrammen, einer unglaublichen Menge an Details. Bei meinen Auszügen konzentriere ich mich auf die ältere Geschichte, da das 20. Jahrhundert ziemlich bekannt ist. | Fue una lectura larga, con muchos cuadros y gráficos, una cantidad increíble de detalles. Con mis extractos, me centro en la historia más antigua, ya que el siglo XX es bastante conocido. |

Introduction

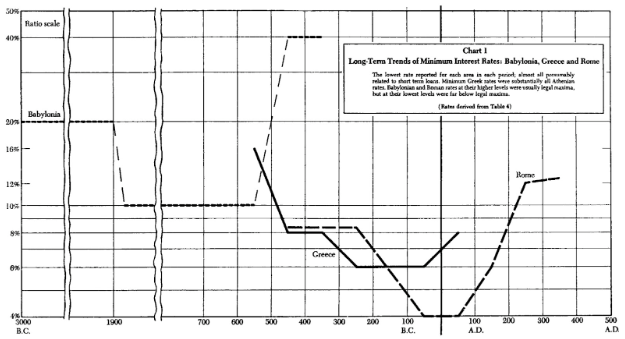

In the charts and tables of interest rates over long periods, students of history may see mirrored the rise and fall of nations and civilizations, the exertions and tragedies of war, and the enjoyments and the abuses of peace. They may be able to trace in the fluctuations the progress of knowledge and technology, the successes and failures of political forms, and the long, hard, and never-ending struggle of democracy with the rule of tyrants and elites. Students of economics may read in the ebb and flow of interest rates the success of some communities and the failure of others to develop effective commercial ethics and laws and suitable monetary and fiscal techniques and policies. They may recognize the effects of economic growth and of economic decline as these two forces alternate over the dimensions of time and space. … The chapters on interest rates in ancient Babylonia, Greece, and Rome show, in each case, a progressive decline in interest rates as the nation or culture developed and throve, and then a sharp rise in rates as each “declined and fell.” … It is not necessary to assume that history repeats itself in any neat pattern. It is not necessary, after a glance at the charts, to cry doom. There is plenty of opportunity to reverse unfavorable trends. It seems fair to say, however, that the free market long-term rates of interest for any industrial nation, properly charted, provide a sort of fever chart of the economic and political health of that nation. Wars and political and economic calamities are recognizable at sight on the charts.

| If a chart of interest rates is a sort of fever chart of a nation, I think most countries had a small flu over the last 2 years. | Wenn ein Chart der Zinssätze eine Art Fieberkurve einer Nation ist, dann denke ich, dass die meisten Länder in den letzten 2 Jahren eine kleine Grippe hatten. | Si un gráfico de tipos de interés es una especie de cuadro febril de una nación, creo que la mayoría de los países han tenido una pequeña gripe en los últimos 2 años. |

In contrast to the Code of Hammurabi, the laws of Solon did away with all limits on the rate of interest. They reduced or canceled many debts. They permitted hypothecation, but they forbade personal slavery for debt. These laws endured for centuries.

Interest rates can be viewed as changing through many dimensions. The principal dimensions are time, space, quality of the loan, and maturity of the loan. Other distinguishing characteristics are marketability, size of loan, redemption terms, legality, tax status, class of debtor, and class of creditor.

In modern advanced countries, government loans usually set a standard for high quality, followed by loans of the best corporations. In medieval and ancient times, there were no great corporations, and government credit was usually inferior to the credit of propertied individuals. From period to period, therefore, the character of best credits shifted and with it the type of loan that receives the most attention here.

| Currently the rate for the 10-year US Treasury Note is considered as the risk-free rate (highest quality debt). Will that change in the years and decades to come? I think so. | Derzeit gilt der Zins für die 10-jährige US-Schatzanweisung als risikofreier Zinssatz (Schuldtitel höchster Qualität). Wird sich das in den kommenden Jahren und Jahrzehnten ändern? Ich denke schon. | En la actualidad, el tipo del bono del Tesoro estadounidense a 10 años se considera el tipo sin riesgo (la deuda de mayor calidad). ¿Cambiará esto en los próximos años y décadas? Yo creo que sí. |

The history of the modern money market began in 12th-century Italy. ... There is more continuity over the centuries in interest rates than there is in most prices. This is because the interest rate is a ratio of like to like. Like rates produce the same mathematical result in any era, in any currency, and at any given price structure. Compound interest at x% net will double principal in exactly the same number of years today as in the days of Socrates, and the net purchasing power of x% interest will be increased or reduced by changes in the value of money or burden of taxes in the same proportion. Because it is such a mathematical ratio, the rate of interest is one of our closest statistical links with our economic past. … Great gaps will be evident in the background history, as in the history of interest rates themselves. Why are several centuries of Hellenistic Greece described in one paragraph, whereas several pages are devoted to one earlier century of Athenian supremacy? The answer is twofold: First, developmental periods require and deserve detailed description, whereas ensuing periods are likely to be repetitious. Second, the sources themselves apportion far more space to periods of financial development than they do to subsequent, longer periods of repetitious activity.

There are fundamental differences that distinguish 4 types of credit, which persist throughout this history: (a) long-term productive loans, (b) short-term working capital loans, (c) nonproductive consumption loans, and (d) loans to governments. As early as the Paleolithic Age, probably before 10,000 BC, a primitive exchange of goods had begun between European and Asiatic tribes which involved amber, shell jewelry, flint, and other commodities suitable for exchange. In a wide area from the Red Sea to Switzerland, Paleolithic shell hoards of sufficient uniformity to suggest their use as a form of money have come down to us. This hypothesis is reinforced by the modern use of just such shells as money by certain South Sea tribes. It is very doubtful, however, that these exchanges and this shell money formed a suitable basis for credit. At the beginning, loans were more likely to have been within tribes or families and in kind.

It was only later, after 8000 BC, during the Mesolithic Age, and especially after 5000 BC, during the Neolithic Age (the dates, of course, are conjectural and differ widely for different locations), that capital and credit became important and provided a main impetus toward human progress. Paleolithic man went out to find his food. Neolithic man produced his own food through agriculture and animal culture. His capital took the form of seeds, improved tools, and especially herds of animals. Capital accumulation led to a great increase in population and the opening up of vast new areas in Asia and Europe. Such capital permitted the further accumulation of possessions, the support of chieftains, and the building of cities.

With the development of town culture in the ancient Orient, credit became very important. Mining had developed, and now inanimate objects, especially metals, such as gold, silver, lead, bronze, and copper, were loaned out at interest. … Coined money is sometimes considered to have originated as pieces of metal stamped by the state as a guaranty of weight or fineness. Alternatively it may have originated as religious tokens. It probably first appeared very late, perhaps in the 7th century BC in Asia Minor. But uncoined metal was used for money for thousands of years before that time. Such pieces of metal have been excavated in Troy, Asia Minor, Minoan and Mycenean settlements, Babylonia, Assyria, Syria, Egypt, and Iran.

A study of primitive money catalogues some 173 objects and materials which in ancient and modern times have had monetary attributes in one or more places and at one or more times. Those most frequently mentioned include beads, cattle, cloth, copper, gold, grain, iron, rice, salt, shells, silver, skins, slaves, and tobacco. It has been suggested that currencies in some areas became standardized because of the difficulty that debtors often met in making exact repayments in kind.

This historical era may be divided into 4 parts: (a) the earliest recorded Sumerian history, circa 3000 BC, down to the first Babylonian dynasty, circa 1900 BC; (b) the Babylonian Empire, 1900 BC, down to the period of Assyrian domination, 732 BC; (c) the period of Assyrian domination of Babylonia, 732–625 BC; and (d) the Neo-Babylonian Empire, 625–539 BC Thereafter followed Persian rule, 539–333 BC, and later the Hellenistic period.

In ancient Sumer in earliest times barley was the medium of exchange for most transactions. In this rich agricultural region grain continued throughout these centuries to be a standard of payment and repayment. However, even before 3000 BC, ingots of copper and silver were also exchanged. There were two standards of value: grain and silver. Silver was used mainly in the town economies that developed in Mesopotamia, while grain was used in the country.

Like early Sumerian custom, the Code [of Hammurabi] set a higher maximum interest rate on loans of grain than on loans of silver.

... To protect the creditor, pledges and sureties were permitted. Pledging of farmland was regulated in detail; the creditor could not take more at harvest time than the principal, if due, plus legal interest. Any property, real or personal, could be pledged—wife, concubine, children, slaves, land, houses, utensils, credits, the door. But servitude for debt could not last more than three years. Later this time limit was extended. Many contracts show that interest (and sometimes principal) on a debt was earned by the labor of a pledged slave or child. The debtor, unable to pay, might himself be reduced to slavery for three years.

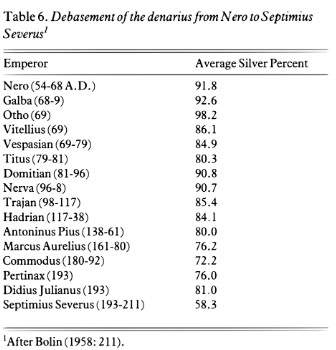

MESOPOTAMIAN INTEREST RATES, 3000–400 BC

In the Sumerian period, 3000–1900 BC, the customary rate of interest for a loan of barley was 331⁄3% per annum and for a loan of silver was 20% per annum. … In the Babylonian period, 1900–732 BC, the Code of Hammurabi recognized the old customary interest rates and established them as legal maxima which lasted more than 1200 years: 33 1⁄3% per annum for loans of grain and 20% per annum for loans of silver. … During the period of Assyrian domination, 732–625 BC, the legal interest maximum in Babylonia was still 33 1⁄3% on grain and 20% on silver; … In the Neo-Babylonian Empire, 625–539 BC, the legal maximum on silver loans remained at 20%, but the maximum on barley loans was reduced to 20%. … After the Persian Conquest, 539 BC, there is some evidence that 40% became a common rate of interest in Babylonia. This was after Mesopotamia had lost her independence. Babylonia was no longer a great capital city. Her old civilization had all but vanished. The center of economic progress and activity had shifted to the Mediterranean and especially to Greece […].

The Bronze Age civilization of the Aegean Sea, which rose and fell between 2400 and 1200 BC, reached a high level of culture and economic activity, but left no specific information on its credit forms and rates of interest. Cattle were the first standard of value, and metals later became mediums of exchange. The metal ingot represented great wealth in small bulk. Ingots were often flat sheets of copper of fixed weight in the shape of an ox hide, which bore a weight stamp: mina, shekel, and so on. Gold and silver were also exchanged by weight. As this was essentially an island civilization, centered at first in Crete, maritime trade was active. Trademarks and commercial documents were in regular use and so probably was Credit. With the fall of Crete in 1400 BC, and especially following the Dorian invasion of 1200 BC, this Minoan-Mycenaean civilization was destroyed. The Iron Age was ushered in by a decline to barbarism.

Public finance in Greece tended to be conservative and traditional. In contrast to the present day, states rarely borrowed. Instead they accumulated treasure in their treasuries. Most famous is the vast treasure of the Athens of Pericles, removed in 454 BC to Athens from Delos, where it had been the war chest of the Delian League. Direct taxes were considered servile and were unknown in the fifth and fourth centuries BC However, voluntary direct taxes, that is, “liturgies,” or gifts to the state, were common, and much later they were merged into capital levies on wealthy men. The mines provided most of the ordinary revenue of Athens. Her armies were supposed to be self-supporting; a good general could find money. Loans to states were thus exceptional until the third and second centuries BC. There were occasional early loans to states, but these were compulsory or of a political character.

- No public debt, no taxes 🥰

Information on Greek interest rates is more abundant than information on interest rates in earlier times or in the Roman period. The Romans were a nation of farmers and soldiers. They left manufacture, commerce, and banking largely to foreigners. Cato said: “In preference to farming one might seek gain by commerce on the seas, were it not so perilous, and in money lending, if it were honorable. . . . How much worse the money lender was considered by our forefathers than the thief. . . .” Nevertheless, Plutarch says that Cato himself invested in mercantile loans, probably secretly.

This attitude probably explains why so few Roman rates of interest were recorded for posterity. Most of Roman interest-rate history consists of legal maxima. Nevertheless, a summary of Roman financial history should serve to explain the significance of those few rates of interest which are quoted.

By the first century BC, Rome was the financial center of the world. Nevertheless, banking firms were still not large and well-known. This may have been because Roman law discouraged limited liability companies for commercial and financial purposes. Joint stock companies with limited liability, however, were permitted to finance public projects. Such companies of “knights” after 179 BC contracted to collect taxes and to construct public works.

- Joint stock companies 2000 years ago 😮

For the first century BC and the first century AD, we have a better record of Roman interest rates than for any earlier or later periods. The rates were very volatile. The volume of gold and silver in Italy had increased rapidly during the late second century BC, and was largely absorbed by commercial expansion and investment in Gaul and Asia. A period of plentiful money and large profits came to an end with the Social War of 90 BC. This led to complete state bankruptcy. In 88 BC, Sulla set the maximum rate of interest at 12%, which suggests that the old 8 1⁄3% limit had fallen into disuse. In 86 BC the Valerian law remitted three fourths of all debts. State debts were repaid only 25%. The Catalinian conspiracy was partly an uprising on behalf of hard-pressed debtors.

In 63 BC the state forbade the export of gold and silver from Italy. When Caesar and Pompey brought in new supplies, the scarcity of money was turned into an abundance. By 54 BC safe loans in Rome were available at far below the legal limit, but the rate would rise during political campaigns. Only risky loans brought the legal limit. Soon after this interval of monetary ease, the civil wars of 49–31 BC again bankrupted Rome and led to ruinous confiscations and a return of high interest rates. Caesar removed the “knights” from tax collecting and from moneylending in Asia and ended their abuses. He attempted to restore credit by permitting bankruptcies at prewar prices. He introduced an issue of gold coin. Caesar personally was a daring borrower and financed an important part of his political rise on credit. Financial stability, however, was not restored until the battle of Actium, 31 BC, and the beginning of the reign of Augustus.

The civil wars destroyed faith in property rights and brought on financial stagnation. Money was hoarded and was scarce and expensive. Confiscation made real estate dangerous to own. Augustus changed all this. He respected property and restored peace and good faith. Hoarded money returned to circulation. The treasures of Egypt were coined and put in circulation. Public building activity was resumed and real estate prices rose. As debts were liquidated interest rates again fell to very low levels. Augustus followed Caesar’s policy of expanding the volume of coin.

After Augustus’ death in 14 AD, Tiberius reduced coinage to a trickle, cut expenses, and hoarded metal in his treasury. At the same time money was moving east to pay for imports. Interest rates rose to the legal limit and beyond. A crisis occurred in 33 AD, due largely to credit disturbances. It began with the prosecution of bankers for overcharging. As a result more loans were called, and the crisis was intensified. The crisis was resolved when finally large sums were withdrawn from the treasury and loaned out for a 3-year term without interest. Succeeding emperors coined much more freely than Tiberius, and Nero even lightened the coins moderately. During the first century AD the metal content of Roman coins was reduced about 25%, and during the second century AD it was reduced substantially more. Silver coins were reduced to the status of token coins. In the third century AD monetary inflation on a grand scale accompanied a succession of revolutions and civil wars. These later centuries have left us little information on credit and finance. The chaotic 50 years before Diocletian, 284–305 AD, were, in the opinion of Tenney Frank, the period when Rome fell. There was anarchy and looting. Provincials lost faith in Rome. Industry and trade disintegrated, and even the Latin speech decayed.

| "There was anarchy and looting" is an oxymoron. Looting is a form of rule/domination while anarchy is the absence of rule/domination. | "Es herrschte Anarchie und Plünderung" ist ein Oxymoron. Plünderung ist eine Form der Herrschaft, während Anarchie die Abwesenheit von Herrschaft ist. | "Hubo anarquía y saqueos" es un oxímoron. El saqueo es una forma de gobierno/dominación, mientras que la anarquía es la ausencia de gobierno/dominación. |

Roman interest rates rose during the second century AD, but were at times still moderate by ancient standards. Roman endowments in Asia and Africa were at that time often based on a conservative earnings expectancy. There is not much difference between second century AD Roman and provincial rates and third-century BC Greek rates. During the late second and the third centuries AD, Roman interest rates probably rose sharply. The period of relatively low interest rates was ended for Western Europe for a thousand years or more.

Medieval and Renaissance Europe

St. Thomas Aquinas, 1225?–1274, cited Aristotle who considered that money was sterile and hence that the breeding of money from money is unnatural and justly hated. Aristotle in fact objected to gain from all commercial transactions.

Often “manifest usurers” were Jews. They were, of course, unaffected by excommunication. They were not excused, and their traffic was deplored and morally condemned. However, the Jews held no monopoly on medieval usury. They were early in the field, but their operations were usually small and marginal. In the 10th or 11th century they were partly supplanted by the Lombards. These were men from Northern Italy who spread through Europe. Later on, the State in the Low Countries and Italy set up public pawnshops which charged lower interest in an effort to supplant Lombards and Jews. Although social opinion was probably directed largely against these “manifest usurers,” the moral code was also opposed to commercial credit if it involved profit from loans. It was this wider prohibition which directly affected the development of trade and banking and the structure of commercial loans and interest rates.

DEPOSIT BANKING

The safekeeping of goods or money by a deposit contract goes back to Greek and Roman times and earlier. It was an early medieval practice. By the 13th century in Italy the deposit had become a means of investment. Deposits of money were left with merchants, often at a variable rate of profit, depending upon the success of the merchant’s ventures. In Genoa deposit banking was well established, and in Florence the merchant banks paid well for deposits from nobles, businessmen, and clergy. In the 15th century the Medici Bank was organized on the basis of deposits made partly by the owners, which drew interest only when earned. Wards and widows were often dependent on interest from deposits.

THE BILL OF EXCHANGE

As early as the 12th century, and probably much earlier, the remittance of foreign exchange was combined with credit. In Genoa foreign exchange was bought or sold, payable at the next Champagne Fair. These great fairs, held several times a year, which brought together importers and exporters from all over Europe, were at times largely financed by Italian bankers. A standard bill of exchange for foreign remittance was developed and became a common instrument of credit in the 14th and 15th centuries.

These bills, however, were not discountable; they were not explicitly in the form of loans. Often the profit was variable and speculative, depending on the exchange rate at a future date at which the banker could reacquire his own currency. Such a profit could not be called either usury or true interest.

A medieval bill of exchange, unlike a modern draft, always originated in an exchange contract. A merchant gave a sum in local currency to another merchant and received a bill payable at a future date in another place and in another currency. A typical contract involved four parties: (a) the “delivered,” who bought the bill at the city of origin; (b) the “taker,” who received the money and made out the bill to a foreign agent of the “delivered”; (c) the “payor,” in a foreign city on whom the bill was drawn, usually a correspondent of the “taker”; and (d) the “payee” in the foreign city, usually a correspondent of the “delivered.”

There existed in the later Middle Ages organized money markets at which the cash price of bills was set by supply and demand. Most such bills were payable “at usance,” that is, at the conventional time for transit of goods between the city of origin and the city of destination—one month, two months, three months, etc. The bills were usually paid, not in specie, but rather by the transfer of a deposit at a bank. While the purchase of bills involved the extension of credit, interest could not be charged openly and was, therefore, concealed in an exchange rate higher than would have prevailed in a cash transaction.

Now that certain outstanding religious leaders ([Luther, Zwingli, Calvin] had expressed doubts about, or opposition to, the biblical doctrine against usury, commercial interests moved rapidly to assure its demise. The controversy lost its religious overtones, but was by no means ended. By 1650, in Protestant countries, the economic effects of different rates of interest were being discussed by the mercantilists. John Locke insisted that the “price of the hire of money” cannot be regulated.

The Dark Ages

During much of the Middle Ages the Western European economy can be discussed in terms of geography rather than of nations. Great organized states usually did not exist, the powers of kings were limited, and the powers of local nobles were often absolute. People did not think and act in terms of nationality. Trade and currencies often crossed national boundaries as easily, or with as great difficulty, as they crossed county boundaries.

FIFTH AND SIXTH CENTURIES

Following the sack of Rome by the Goths, in 410, and by the Vandals, in 455, barbaric kingdoms prevailed throughout Western Europe: Franks in Gaul, Visigoths in Spain, Ostrogoths and later Lombards in Italy, Angles, Saxons, and Jutes in Britain. These kingdoms, however, generally retained what they could of the Roman civilization. The barbarians had been taught to admire Rome and Roman culture. Their kings often accepted honorary titles from the Roman emperor at Constantinople with appreciation. They sometimes requited him with services. “No violent break had intervened between the centuries officially Roman and those officially barbaric.”

SEVENTH AND EIGHTH CENTURIES

In 622 occurred the fateful Hegira of Mohammed, which led to economic consequences as important as its political and religious consequences. In 632 the Arabs conquered Syria, Egypt, and Persia; in 669 they seized Asia Minor; and in 698, Carthage. In 711 they crossed over to Spain, defeated the Visigoths, and held this European western flank for centuries thereafter. Although their further attempt to complete the conquest of Europe was defeated by Charles Martel at the Battle of Tours in 732, the Arabs almost held southwest Europe in siege. An essential economic fact was that the Mediterranean was all but closed to commerce. Only the ports of southern Italy, the Adriatic, and the Aegean remained open. Syrian navigation between the ports of the west and Asia and Egypt ceased. From the beginning of the 8th century, western European commerce was profoundly depressed. Although the Arabs had been stopped at the Pyrenees, no counterattack to reopen the seas could even be attempted. The empire of Charlemagne was essentially landlocked. The Danes were plundering England. The Vikings dominated the northern waters. This interruption of commerce accelerated the ruin of merchants and the decline of cities. Western Europe at the time of Charlemagne, 742–814, stopped using imported luxuries. It was sinking back into a largely agricultural economy. The Latin tongue was forgotten, culture vanished, and superstition throve. Roman serfdom became the basis of feudalism. Absolute self-sufficiency, however, was never achieved even by the great estates. Trade in salt, metals, food, wines, and cloth continued. The nadir of economic activity probably was reached for different commodities and in different parts of Europe in different centuries.

Money was used regularly throughout the darkest of the dark ages, but the lack of commerce reduced its circulation. Yet, just at this point, Charlemagne devised a new silver coinage to supplant the Roman gold coinage. His new small-denomination silver coins were well suited to an agricultural economy that did not know trade on a great scale. His currency subdivisions survived to this century. The only tangible coin was the silver penny (denier), but for accounting purposes twelve pence equaled one shilling (sou), and 20 shillings equaled one pound.

NINTH CENTURY

The 9th century perhaps marked the low ebb of European economic life in many places, in spite of the formation of the Holy Roman Empire in 800. Arab pirates now infested the Mediterranean shore. They advanced to Rome and even beseiged the castle of St. Angelo. They were masters of Africa, and after 878 they dominated Sicily. They controlled the islands of the Mediterranean and the coastal waters, and Europeans all but abandoned the sea.

TENTH CENTURY

The 10th century has been called the century of transition. In superficial respects the plight of much of western Europe grew worse. Many economic activities deteriorated further. Simultaneously history records the quiet beginnings of trends and forces that can be recognized as the forces behind a new economic revival. They can be seen with the benefit of hindsight, but it is safe to say that contemporary seers can hardly have made favorable forecasts. Petty warfare continued throughout much of western Europe. There was still very little communication between it and the Saracen ports of Spain, Africa, and the East. Arab pirates pillaged Pisa in 935 and again in 1004; they destroyed Barcelona in 985. The Arabs even established an outpost in the Alps. Coastal bishoprics in the south had to be transferred inland. To compound evils, terrible cavalry raids from Hungary began and were combined with Arab threats from the south and Viking threats from the north and west. Europeans built castles: “burgs” garrisoned by knights, living off the land but making no economic contribution. … The population of Europe, which had been declining for centuries, probably began to increase after the middle of the 10th century. Europe had been delivered from the pillages of the Arabs, the Norse, and the Hungarians. Surplus serfs ran away and tried their luck in the world. The younger sons of knights sought adventure and gain.

ELEVENTH CENTURY

During the 11th century, political and economic revival in western Europe became general. Pisans and Genoese took the offensive against the weakening Arab power. They conquered Sardinia and attacked Arab Sicily and the coast of Africa. They freed the Tyrrhenian Sea. They recaptured Corsica in 1091. The Normans destroyed Arab power in Sicily. Finally, the first Crusade, 1096, established the control of the Mediterranean by the Italian cities. European trade with the East was thereby greatly enlarged. At the same time trade on the North Sea revived. The Vikings had turned merchant traders. They traded from the Thames and the Rhine to Iceland and Greenland, to the Dvina and Constantinople.

Canute, 1017–1035, for a while united England, Denmark, and Norway. Later, the Norman Conquest strengthened England’s commercial ties with the continent. Tiel became a commercial center. Ships began to put into Bruges, and industry expanded in Flanders. The most famous of the old international trade fairs began in Champagne. In such places a feudal peace replaced feudal anarchy. Italian traders came northward through the Alps and began to meet northern traders at these fairs. More continental merchants frequented London. There was a growing trade in wine, cloth, and timber. In this century something like a commercial code was developed among merchants, a collection of usages.

LATE MEDIEVAL TIMES TWELFTH CENTURY

During the 12th century the economic development of western Europe accelerated. It mattered little that the Turks drove the Europeans from Jerusalem in 1187; the Turks had no fleet. The Italians continued to control the Mediterranean. They traded with the Turks and with the Arabs. The Crusades were very good for shipping and commerce. Genoa came forward to compete with Venice for Eastern trade; by this time both cities rivaled in wealth the great commercial centers of antiquity. Marseilles and Barcelona joined the competition. Westerners monopolized Byzantine trade. European culture borrowed from Byzantine and Arabic sources. Learning revived and Gothic cathedrals were built in the north. The power of the victorious Papacy reached its height under Innocent III, 1198–1216. Kings allied themselves with the growing towns in their struggles with the nobles and with the Church. In France and elsewhere the power of the kings began to increase.

At this point the history of specific interest rates can be resumed after a lapse of almost a thousand years. As might be expected, the data at first are scarce and general. Creditors probably rarely recorded their usury for the enlightenment of posterity. Definitions are uncertain. We must be satisfied with scraps of evidence: this or nothing.

THIRTEENTH CENTURY

This was a century of continued economic expansion. It was the century of the Mongol conquest of Asia, from which the Arab World never recovered. This conquest led to a great Asiatic peace which opened Asia as far as China to European trade. It was the century of Marco Polo, 1254?– 1324, and of St. Thomas Aquinas, 1225?–1274. It saw the end of the great Crusades, with the defeat of St. Louis (IX), 1214–1270. Western Europeans, backed by the Venetian fleet, for a while ruled Constantinople. The Teutonic knights completed their conquest of Eastern Germany, Prussia, and Lithuania. Cordova and Seville were recaptured from the Moors. Trade and prosperity rose to their highest medieval level. Roads, however, were still wretched and, local tolls were still multiplying.

The population of Europe continued to increase, and free labor grew very fast and became urbanized. Prices continued to rise. Nobility often incurred debt and ruin. Emancipated peasants often owned their soil in return for a census (mortgage), which sometimes was an hereditary obligation. Rural peace was reestablished in many places and trade security grew. Therefore, merchant adventurers began to stay at home and send agents abroad. This trend later led to the decline of the fairs. Foreign hosts, called brokers, who had entertained traveling merchants, began to act for them and later developed brokerage monopolies. Many merchants became purely investors; others joined forces in great companies which supplanted the individual adventurer. … The currencies of Europe were still in debased confusion. In order to provide reliable currency, some superior gold coins were struck by trading cities: the florin in Florence, 1252; the ducat in Venice, 1284.

The credit of the best merchants and the credit of free towns was generally much better than the credit of princes. Towns could pledge the wealth of their burghers to perpetuity. Towns generally had to make good on commitments in order to preserve their prized sovereignty, and their credit enjoyed continuity from generation to generation. Their sources of revenue were systematic and reliable and, therefore, could be pledged. Merchants’ credit was in effect secured by their physical assets, which were generally realizable in case of a shortage of cash; furthermore, merchants were under necessity to maintain good credit or else lose their power to trade.

Have a great day,

zuerich

!PIZZA !wine

Fascinating. The book is very expensive to buy but I found a PDF online!http://vnn1.online.fr/Cafeteria/Financial_Accounting_Banking/A.History.of.Interest.Rates.Wiley.Finance.Series.4th.Ed.eBook-YYePG.pdf

So much in here that scrolling through your blog does not do the topic justice. This will provide many nights of bedtime reading on my iPad. Certainly I will ignore the charts and formulas. I have a head for history but no head for numbers :)

!LOL

lolztoken.com

Well, it is more of a rap really.

Credit: reddit

@zuerich, I sent you an $LOLZ on behalf of holovision.cash

(10/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

Congratulations @zuerich! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 135000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: